Billionaire Masayoshi Son, chairman and chief govt officer of SoftBank Group Corp., speaks in entrance of a display screen displaying the ARM Holdings emblem throughout a news convention in Tokyo on July 28, 2016.

Tomohiro Ohsumi | Bloomberg | Getty Images

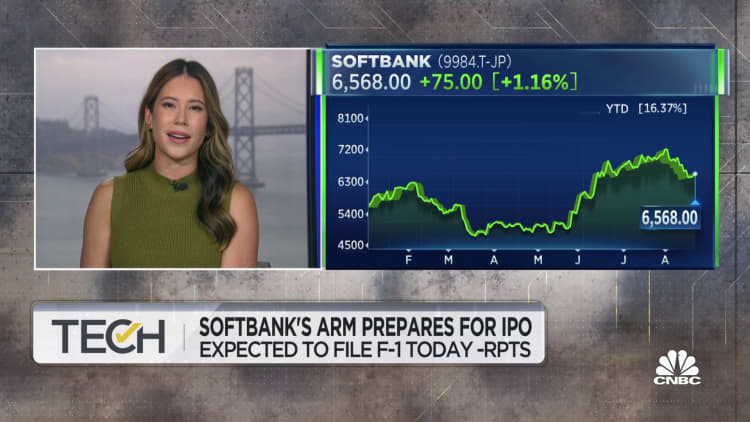

Arm, which is owned by SoftBank, filed for its preliminary public providing Monday. The agency’s inventory market debut shall be a significant take a look at for the IPO market, which has roughly closed off from new listings because of rising rates of interest which have hammered urge for food for dangerous property within the final 12 months or so.

Arm is among the most vital firms in expertise. Its chip designs present in almost all of the world’s smartphones, together with Apple iPhones and most Android units. Its debut shall be an enormous deal for an IPO market that is been within the doldrums since 2022, however the firm’s itemizing has huge implications for SoftBank as nicely.

SoftBank has been making an attempt to bounce again from a grim tech market by reining in on its growth-focused investments and pivoting its focus to synthetic intelligence, the recent subject of the hour in tech.

What is Arm?

Arm, which is headquartered in Cambridge, England, designed the structure of chips present in 99% of all smartphones.

The firm traces its historical past to an early computing firm referred to as Acorn Computers. In 1990, Acorn spun out a brand new firm named Advanced RISC Machines, structured as a three way partnership between Acorn, Apple and U.S. chipmaker VLSI Technology.

Arm is not a chipmaker itself. Rather, the corporate is answerable for arising with the “architectures” — or total designs, together with elements and programming language directions that different firms use to construct chips. Its authentic worth was designing chips with extraordinarily low power consumption in contrast with the X86 chips widespread in private computer systems on the time. It’s seen as one thing of a impartial social gathering or “Switzerland” in tech, since its designs are utilized in almost smartphone processors, together with these made by Apple, and more and more, server and laptop computer processors as nicely.

It’s additionally usually thought-about the crown jewel of the U.Ok.’s expertise sector.

Speaking with CNBC at a developer convention in October 2022, Arm CEO Rene Haas mentioned that firms cannot afford to not work with the corporate, given its expertise is embedded in just about each gadget on the market.

“Given the fact that we license the technology to all the major players in the industry, no one can really afford to miss a product cycle or scale back on R&D or not do a product,” Haas mentioned on the time.

Arm’s business mannequin is to license the mental property for these architectures in order that they’ll construct programs round them. In current years, ARM has tried to promote its personal designs for processors, a extra profitable business than simply licensing the underlying structure expertise.

SoftBank agreed to amass Arm in 2016 for $32 billion, which on the time was the biggest-ever buy of a European expertise firm. SoftBank on the time mentioned it was buying the business to achieve a foothold within the rising web of issues sector. IoT, is a small a part of the agency’s business, however on the time it was a much-hyped a part of tech.

Not only for wearables or sensible house home equipment, Arm has been increasing its semiconductors to different makes use of resembling linked automobiles.

For the quarter ended June 30, the corporate generated 88.5 billion Japanese yen ($605.5 million), based on an earnings launch from SoftBank.

But the corporate can be dealing with headwinds from a slowdown in demand for merchandise like smartphones, which has hit chip companies throughout the board. Arm’s internet gross sales fell 4.6% year-on-year within the second quarter.

The unit additionally swung to a 9.5 billion yen loss, having made a revenue of 29.8 billion yen in the identical interval a 12 months earlier.

Beleaguered sale to Nvidia

SoftBank initially tried to promote Arm to chip big Nvidia, however the deal confronted pushback from regulators, who raised issues over competitors and nationwide safety. Nvidia is a behemoth on the earth of semiconductors, and the corporate is now benefiting closely from the growth in AI purposes as demand for its GPUs soars.

Since then, SoftBank has opted to listing Arm as an unbiased firm. The Japanese tech investing big is reportedly trying to buy the remaining 25% stake in Arm that it doesn’t at the moment personal from its large $100 billion Vision Fund.

In the U.Ok., which has sought to spice up its home chip business by means of as much as £1 billion ($1.3 billion) in investments, Arm is seen as strategically vital.

The change of the corporate’s possession to international arms is seen as a thorny subject for the home tech business, not least because of issues that it undermines the U.Ok.’s “tech sovereignty,” a problem that has cropped up all through Europe as officers look to scale back dependence on expertise from the U.S. and different nations.

The authorities had pushed aggressively for Arm to listing in London, nonetheless the corporate opted to go together with New York for its debut as a substitute, dealing a blow to the London inventory alternate.

Testing a uneven IPO market

SoftBank is pushing forward with an inventory of Arm at the same time as U.S. markets have been in an unsteady state. Technology valuations have fallen sharply from the height of the 2021 tech growth.

That 12 months, shares of newly minted public firms resembling Palantir and UiPath rose to seismic ranges as traders grew excited by their progress prospects within the growth occasions.

Arm filed confidentially for an inventory within the U.S. earlier this 12 months. It’s not but clear what valuation SoftBank is searching for for Arm, nonetheless reviews have pegged the possible market worth at between $60 billion and $70 billion.

As nicely as being a bellwether for the chip business, Arm performs a job within the AI area — and is more and more touting itself as an AI firm. Investors shall be watching out for the corporate’s S-1 submitting to see the way it sees the expertise benefiting its business over time.

In May, Arm unveiled two new chipsets focused at machine studying purposes. One, a brand new CPU known as Cortex-4, is a chipset that delivers sooner machine-learning efficiency and consumes 40% much less energy than its predecessor, based on Arm. The different, a GPU known as G720, presents higher efficiency and makes use of up 22% much less reminiscence bandwidth than its predecessor, Arm mentioned.

“Arm remains committed to developing and testing our GPUs against new applications for machine learning (ML),” the corporate mentioned in a May 29 weblog submit saying the merchandise.

High-powered chips resembling these supplied by Nvidia and AMD are essential to AI purposes, which require numerous computing energy to run easily. Earlier this month, Nvidia unveiled its new Grace Hopper chip for generative AI purposes, which relies on Arm structure.

SoftBank is banking on the expansion in AI to elevate the prospects of its Vision Fund, which has flagged in tandem with souring bets on companies like WeWork, China’s ride-hailing big Didi Global, and Uber, the latter of which the Vision Fund has since shed its holdings.

SoftBank’s CFO Yoshimitsu Goto mentioned through the firm’s June quarter earnings name that the corporate has been “carefully and slowly emerging back to investment activity,” with a give attention to AI investments.

SoftBank mentioned its Vision Fund booked an funding achieve of 159.8 billion yen, its first achieve in 5 consecutive quarters. SoftBank mentioned the fund primarily benefited from investments in its personal subsidiaries — together with Arm.

That nonetheless got here after SoftBank’s Vision Fund reported a file 4.3 trillion yen loss within the fiscal 12 months ending Mar. 31.

The Japanese tech big has been beginning to speak up its investments in AI lately. In July, the corporate led a $65 million funding in U.Ok. insurance coverage expertise firm Tractable.

– CNBC’s Kif Leswing contributed to this story.

Source: www.cnbc.com