A video signal shows the emblem for Roku Inc, a Fox-backed video streaming agency, in Times Square after the corporate’s IPO on the Nasdaq Market in New York, September 28, 2017.

Brendan McDermid | Reuters

Roku has $487 million of money and money equivalents in uninsured deposits at failed Silicon Valley Bank, the streaming media firm mentioned in an submitting on Friday with the Securities and Exchange Commission.

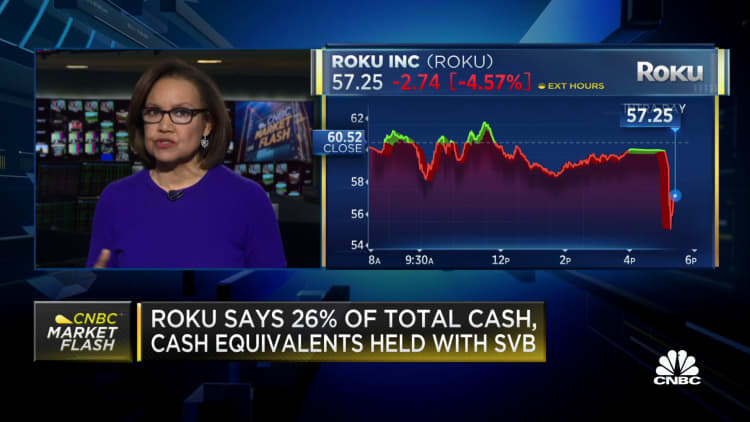

About 26% of Roku’s $1.9 billion in money was deposited with SVB, which was positioned into receivership by the Federal Deposit Insurance Corp. noon Friday.

Roku shares fell over 4% in prolonged buying and selling on the news.

“At this time, the Company does not know to what extent the Company will be able to recover its cash on deposit at SVB,” Roku mentioned in a press launch.

Nonetheless, Roku mentioned it believed it might have the ability to meet its capital obligations for the “next twelve months and beyond” with its unaffected $1.4 billion in money reserves at different “large financial institutions.”

“As stated in our 8-K, we expect that Roku’s ability to operate and meet its contractual obligations will not be impacted,” a Roku spokesperson mentioned in a press release to CNBC.

The collapse of SVB jarred each massive and small firms alike. As the favored lender and banker for a lot of Silicon Valley startups and enterprise capital companies, the corporate’s receivership has alarmed founders, who fear about assembly payroll and demanding obligations with restricted money accessible.

FDIC insurance coverage solely covers the primary $250,000 in deposit accounts, a fraction of the money that Roku and plenty of different firms had vaulted with SVB.

Source: www.cnbc.com