In this photograph illustration, a visible illustration of the digital Cryptocurrency Ripple is displayed on January 30, 2018 in Paris, France.

Chesnot | Getty Images

Blockchain startup Ripple is assured U.S. banks and different monetary establishments within the nation will begin exhibiting curiosity in adopting its XRP cryptocurrency in cross-border funds after a landmark ruling decided the token was not, in itself, essentially a safety.

The San Francisco-based agency expects to start out talks with American monetary companies about utilizing its On-Demand Liquidity (ODL) product, which makes use of XRP for cash transfers, within the third quarter, Stu Alderoty, Ripple’s common counsel, informed CNBC in an interview final week.

associated investing news

Last week, a New York choose delivered a watershed ruling for Ripple figuring out that XRP itself is “not necessarily a security on its face,” contesting, partly, claims from the U.S. Securities and Exchange Commission towards the corporate.

Ripple has been combating the SEC for the previous three years over allegations from the company that Ripple and two of its executives carried out an unlawful providing of $1.3 billion price through gross sales of XRP. Ripple disputed the claims, insisting XRP can’t be thought-about a safety and is extra akin to a commodity.

Ripple’s business suffered because of this, with the corporate shedding at the least one buyer and investor. MoneyGram, the U.S. cash switch big, ditched its partnership with Ripple in March 2021.

Meanwhile, Tetragon, a U.Okay.-based investor that beforehand backed Ripple, offered its stake again to Ripple after unsuccessfully making an attempt to sue the corporate to redeem its money.

Asked whether or not the ruling meant that American banks would return to Ripple to make use of its ODL product, Alderoty stated: “I think the answer to that is yes.”

Ripple additionally makes use of blockchain in its business to ship messages between banks, sort of like a blockchain-based various to Swift.

“I think we’re hopeful that this decision would give financial institution customers or potential customers comfort to at least come in and start having the conversation about what problems they are experiencing in their business, real-world problems in terms of moving value across borders without incurring obscene fees,” Alderoty informed CNBC Friday.

“Hopefully this quarter will generate a lot of conversations in the United States with customers, and hopefully some of those conversations will actually turn into real business,” he added.

Ripple now sources most of its business from exterior of the U.S., with Alderoty beforehand telling CNBC that, “[Ripple], its customers and its revenue are all driven outside of the U.S., even though we still have a lot of employees inside of the U.S.,” he added.

Ripple has over 750 staff globally, with roughly half of them based mostly within the U.S.

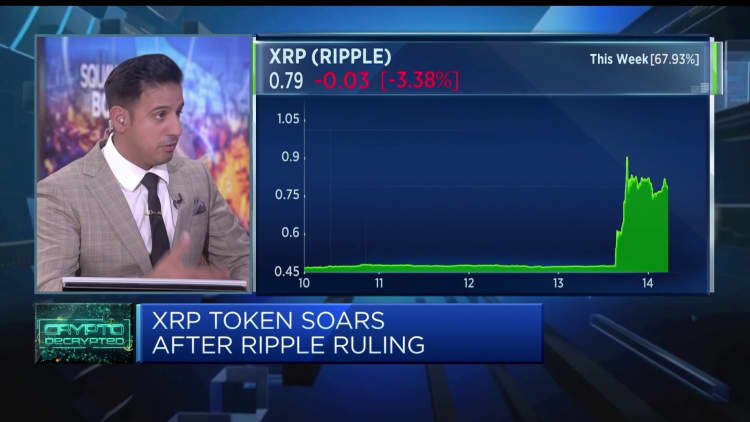

XRP is a cryptocurrency that Ripple makes use of to maneuver cash throughout borders. It is presently the fifth-largest cryptocurrency in circulation, with a market capitalization of $37.8 billion.

The firm makes use of the token as a “bridge” forex between transfers from one fiat forex to a different – for instance, U.S. {dollars} to Mexican pesos – to resolve the problem of needing pre-funded accounts on the opposite finish of a switch to attend for the cash to be processed.

Ripple says XRP can allow cash actions in a fraction of a second.

Still, the ruling didn’t characterize a complete win for Ripple. While the choose said XRP was not a safety, in addition they stated that some gross sales of the token did qualify as securities transactions.

For instance, about $728.9 million of gross sales of XRP to establishments the corporate labored with did qualify as securities, the choose stated, stating there was a typical enterprise, an expectation of revenue.

Alderoty conceded it was not a complete win for Ripple, and that the corporate would research the choice in the end to see the way it impacts its business.

“She [Judge Analisa Torres] found — although we had disagreed with her — that our earlier sales directly to institutional buyers had the attributes of a security and should have been registered,” he stated.

He stated Ripple’s business because it stands can be unaffected by that part of the ruling as its prospects are primarily situated exterior of the U.S.

“We’ll study the the judge’s decision, we’ll look at our clients’ needs to look at the market, and see if there’s a situation here that complies with the four corners of what the judge found when it comes to institutions,” he stated.

Source: www.cnbc.com