The BlockFi emblem on a smartphone organized within the Brooklyn borough of New York, on Thursday, Nov. 17, 2022.

Gabby Jones | Bloomberg | Getty Images

There was supposedly one man who may save crypto — Sam Bankman-Fried. The former FTX CEO bailed out and took over crypto companies as cryptocurrency markets withered with Terra’s spring crash. In October, FTX received the bidding battle for bankrupt crypto agency Voyager Digital in a extremely advantageous deal.

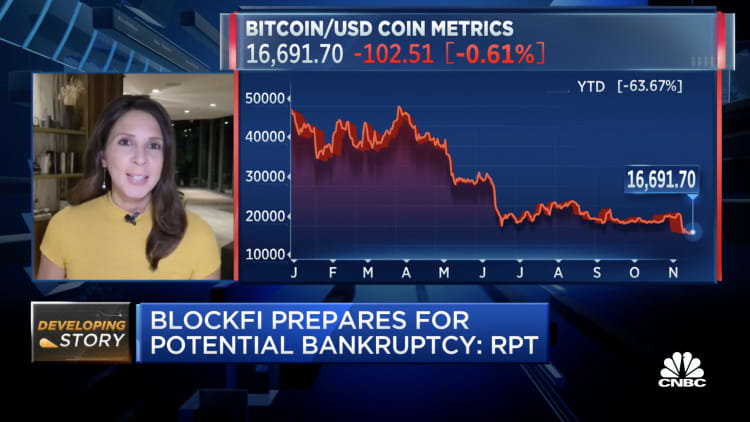

With the collapse of FTX, the companies which Bankman-Fried saved now discover themselves in an unsure state. Voyager put itself again up for public sale final week. Today, BlockFi filed for chapter in New Jersey, after weeks of hypothesis that the FTX collapse had fatally crippled it.

The FTX “death spiral,” as BlockFi advisor Mark Renzi put it, has now unfold to a different crypto entity. BlockFi’s chapter had been anticipated for a while, however in an in depth 41-page submitting, Renzi walks collectors, traders, and the court docket by his perspective on the helm of BlockFi.

According to Renzi, publicity to 2 successive hedge fund failures, the FTX rescue, and broader market uncertainty all conspired to power BlockFi into chapter 11.

Renzi is eager to underscore that from his viewpoint, BlockFi would not “face the myriad issues apparently facing FTX.” Renzi pointed to a $30 million settlement with the SEC and the corporate’s company governance and danger administration protocols, writing that BlockFi is “well-positioned to move forward despite the fact that 2022 has been a uniquely terrible year for the cryptocurrency trade.”

The “issues” that Renzi check with could embody FTX’s nicely publicized lack of economic, danger, anti-money laundering (AML), or audit programs. In a court docket submitting, newly appointed FTX CEO John Ray mentioned he’d by no means seen “such a complete failure of corporate controls” as in FTX.

Indeed, Renzi is eager to underscore BlockFi’s variations from FTX, and certainly argues that FTX’s intervention in summer time 2022 in the end worsened outcomes for BlockFi. Renzi is a managing director at Berkeley Research Group (BRG), which BlockFi has enlisted as a monetary advisor for his or her Chapter 11 proceedings.

Both BRG and Kirkland & Ellis, BlockFi’s authorized advisor, have expertise in crypto bankruptcies. Kirkland and BRG each represented Voyager throughout its failed public sale to FTX. Both companies have already collected tens of millions in charges from BlockFi in preparation work for the chapter, in line with court docket filings.

Similarly to filings in Voyager and Celsius Network’s bankruptcies, Renzi factors to broader turbulence within the cryptocurrency markets, accelerated by the collapse of crypto hedge fund Three Arrows Capital, because the driving power behind BlockFi’s liquidity disaster.

BlockFi, like Celsius and Voyager, supplied exceptionally excessive rates of interest on buyer crypto accounts. All three companies have been ready to take action due to cryptolending — loaning buyer cryptocurrencies to buying and selling companies in trade for top curiosity and collateral. Three Arrows, or 3AC was “one of BlockFi’s largest borrower clients,” Renzi mentioned in a court docket submitting, and the hedge fund’s chapter pressured BlockFi to hunt exterior financing.

A brand new spherical failed for BlockFi. Traditional third-party traders have been scared off by “unfavorable” market situations, Renzi mentioned in a submitting, forcing them to show to FTX simply to make good on buyer withdrawals. Unlike Voyager or Celsius, BlockFi had not halted buyer withdrawals at that time.

FTX assembled and delivered a pacakge of loans as much as $400 million. In return, FTX reserved the proper to amass BlockFi as quickly as July 2023, the court docket submitting mentioned.

While FTX’s rescue package deal did initially buoy BlockFi, dealings with FTX’s Alameda Research Limited additional undercut BlockFi’s stability. As Alameda unwound and FTX moved nearer to chapter, BlockFi tried to execute margin calls and mortgage remembers on their Alameda publicity.

Ultimately, although, Alameda defaulted on “approximately $680 million” of collateralized loans from BlockFi, “the recovery on which is unknown,” the court docket submitting mentioned.

BlockFi was pressured to do what it had resisted doing throughout the Voyager and Celsius meltdowns. On November 10, the day FTX filed for chapter, BlockFi paused buyer withdrawals. Investors, like at FTX, Voyager, and Celsius, are actually left in limbo, with no entry to their funds.