Sergino Dest of USA and Milad Mohammadi of Iran battle for the ball through the FIFA World Cup Qatar 2022 Group B match between IR Iran and USA at Al Thumama Stadium on November 29, 2022 in Doha, Qatar.

Matteo Ciambelli | Defodi Images | Getty Images

There have been Super Bowl advertisements, area sponsorships and superstar endorsements. TV commercials landed through the nightly news. Money flooded onto Facebook, Twitter and TikTok.

Crypto firms have been spending anyplace and in every single place.

Through October of 2022, crypto-related manufacturers shelled out $223 million on advertisements within the U.S., up 150% from $89 million for all of final 12 months, in accordance with MediaRadar. Few have been as aggressive as Crypto.com, which mentioned in late 2021 it was committing $100 million to an advert marketing campaign that may function Matt Damon and run throughout 20 international locations. The firm is an official sponsor of the 2022 World Cup happening in Qatar.

What the crypto trade giveth, it will possibly taketh away.

The beautiful collapse this month of cryptocurrency change FTX and founder Sam Bankman-Fried’s broader empire spells additional bother for ad-supported media companies that had come to see crypto as a brand new development engine with cash to burn. And FTX is way from the one downside, because the contagion has been spreading for months.

Coinbase has misplaced over 80% of its worth and the corporate lower 18% of its employees in June, when CEO Brian Armstrong admitted the business grew too rapidly and harassed “the need to manage expenses.” Crypto.com has reportedly lower 40% of its workforce, eToro downsized by 6% and in July canceled a deliberate merger with a particular function acquisition firm, and BlockFi simply declared chapter.

“Crypto winter is a crypto advertising winter,” mentioned Grant Harbin, CEO of efficiency advertising agency Headlight, which has labored with firms within the trade. “There’s probably very little consideration on scaling advertising budgets right now.”

In the third quarter of this 12 months, the highest crypto advertisers spent simply $35 million on advertisements, in accordance with MediaRadar, an 80% drop from the primary quarter, which obtained an enormous increase from the nation’s single largest sporting occasion — the Super Bowl.

The pullback in spending, which is predicted to accentuate given the trade’s deepening turmoil, is notable as ad-based firms face broader challenges from hovering inflation and fears of a recession. But whereas crypto represented a promising space for development, it nonetheless makes up a tiny portion of the general advert market.

Companies total are anticipated to spend virtually $89 billion on TV advertisements this 12 months, throughout linear programming and related units, and near $250 billion on digital advertisements, in accordance with Insider Intelligence.

Facebook (together with Instagram), Snap, Twitter and TikTok mixed are anticipated to drag in $57.1 million in advertisements from crypto exchanges this 12 months, in accordance with SensorTower. That’s about even with 2021 figures, although virtually the entire spending final 12 months was on Facebook and Instagram.

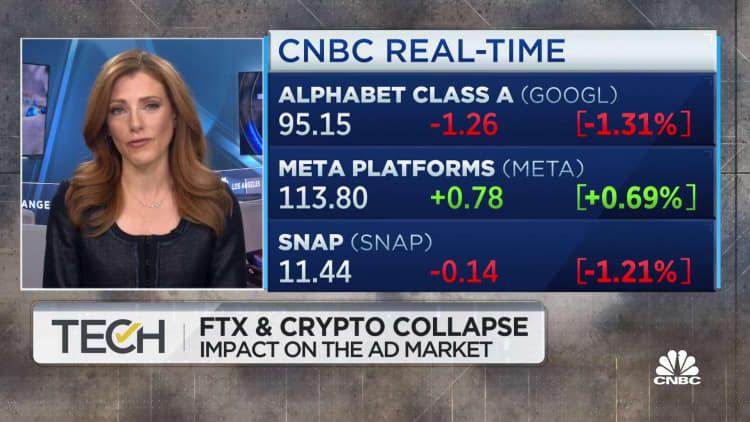

In Alphabet‘s third-quarter earnings name final month, the corporate blamed a slowdown in income development partly on diminished advert spending by cypto firms and different monetary companies. Google’s gross sales development was the slowest for any interval since 2013, aside from one quarter throughout the Covid pandemic.

The spending curler coaster

SensorTower information reveals an enormous spike in crypto advert spending on digital media round October and November of final 12 months, as costs have been peaking, and a steep drop after the primary quarter of this 12 months. In April, the crypto sell-off started in earnest, with bitcoin and ether every shedding properly over half their worth over the subsequent three months.

The Super Bowl created a spending splurge that the trade might by no means see once more. A 30-second spot through the NFL’s grand finale in February price an common of $6.5 million, and crypto was an enormous theme.

Coinbase, Crypto.com, eToro and FTX spent a mixed $54 million on Super Bowl advertisements, in accordance with MediaRadar. Coinbase aired a 60-second business exhibiting a bouncing QR code that, as soon as scanned, led to a promotion providing $15 value of free bitcoin to new customers. FTX signed up Larry David for an advert, urging viewers to not miss out on crypto and declaring NFTs “the next big thing.” A model of “Fly Me to the Moon” performed throughout eToro’s business.

Promotional prices weren’t restricted to airtime.

In 2021, Crypto.com paid $700 million to place its identify on the house of the Los Angeles Lakers for the subsequent 20 years. FTX signed a 19-year deal value $135 million with the NBA’s Miami Heat for naming rights to the workforce’s area, partnered with the NBA’s Golden State Warriors and had its brand positioned on uniforms worn by Major League Baseball umpires.

Miami-Dade County is now attempting to get the FTX named scrubbed from the world. Miami has grow to be a serious hub for the crypto trade, and in September FTX moved its U.S. headquarters there from Chicago. The firm unfold its wings within the metropolis, sponsoring a three-day crypto weekend in May on South Beach referred to as “FTX Off the Grid.”

Jordan Levy, a Miami-based enterprise capitalist, mentioned that whereas different crypto firms have marketed within the metropolis, FTX was on one other stage.

“None of them have as significant of a presence in Miami as Bankman-Fried and FTX,” mentioned the managing companion of SBNY, previously SoftBank New York. “They’ve tried to do some guerrilla marketing stuff that put them on the top of the food chain from perception perspective.”

The cash FTX was spending now presumably goes to zero. According to SensorTower, the corporate’s on-line advert spending quadrupled this 12 months to $13.3 million, with roughly half of that coming within the first quarter.

Crypto.com’s on-line advert spending plummeted from about $16.2 million within the first quarter to $1.6 million within the third, SensorTower mentioned. And Gemini, the change owned by the Winklevoss twins, lower spending from $8.5 million the primary quarter to $2,500 within the third.

Coinbase, the one main change that is publicly traded within the U.S., mentioned in its earnings report this month that its gross sales and advertising expense dropped 46% within the third quarter from the prior interval to $76 million. The firm attributed the decline to “our decision to reduce performance marketing, due to lower efficiency in this spend associated with softer crypto market conditions as well as savings associated with our headcount reduction.”

Coinbase did not reply to a request for remark.

A Crypto.com spokesperson mentioned by way of e mail that the corporate’s $100 million marketing campaign ran from October 2021 via February 2022. Since then, “we ran additional advertising as part of our marketing strategy, and we continue to focus on our global brand and sports partnerships,” the spokesperson mentioned. That consists of sponsorship of the World Cup.

Brad Michelson, eToro’s U.S. head of promoting, mentioned the Israel-based funding platform will “actively adjust spend based on performance,” and plans to proceed constructing its model within the U.S.

“It’s no secret that the markets are in a pull-back phase, and our budgets are being reallocated accordingly,” Michelson advised CNBC in an announcement.

The crypto market has suffered downturns previously, solely to bounce again and entice even better sums of money and new entrants.

Joseph Panzarella, director of digital media and advertising on the Yeshiva University’s Katz School of Science and Health, mentioned that even when the market begins recovering, the high-profile scandals of 2022 will power firms to take a extra severe method when selling their choices.

“What they came out with was like, ‘Hey, we’re going to stick it to the Fed,'” Panzarella mentioned, referring to the trade’s concentrate on decentralization and its capability to perform with out the heavy hand of presidency. “I guess they have to eat a little crow and say something like, ‘Hey, we are now we’re now [open to] being regulated.'”

WATCH: FTX’s chapter places elevated stress on the advert market