Prices of fruit and greens are on show in a retailer in Brooklyn, New York City, March 29, 2022.

Andrew Kelly | Reuters

Global markets have taken coronary heart in latest weeks from information indicating that inflation might have peaked, however economists warn in opposition to the return of the “transitory” inflation narrative.

Stocks bounced when October’s U.S. client worth index got here in beneath expectations earlier this month, as buyers started to guess on an easing of the Federal Reserve’s aggressive rate of interest hikes.

associated investing news

While most economists count on a big normal decline in headline inflation charges in 2023, many are uncertain that this may herald a elementary disinflationary pattern.

Paul Hollingsworth, chief European economist at BNP Paribas, warned buyers on Monday to beware the return of “Team Transitory,” a reference to the college of thought that projected rising inflation charges at the beginning of the yr can be fleeting.

The Fed itself was a proponent of this view, and Chairman Jerome Powell ultimately issued a mea culpa accepting that the central financial institution had misinterpret the state of affairs.

“Reviving the ‘transitory’ inflation narrative might seem tempting, but underlying inflation is likely to remain elevated by past standards,” Hollingsworth stated in a analysis observe, including that upside dangers to the headline price subsequent yr are nonetheless current, together with a possible restoration in China.

“Big swings in inflation highlight one of the key features of the global regime shift that we believe is underway: greater volatility of inflation,” he added.

The French financial institution expects a “historically large” fall in headline inflation charges subsequent yr, with virtually all areas seeing decrease inflation than in 2022, reflecting a mix of base results — the detrimental contribution to annual inflation price occurring as month-on-month modifications shrink — and dynamics between provide and demand shift.

Hollingsworth famous that this might revive the “transitory” narrative” next year, or at least a risk that investors “extrapolate the inflationary developments that emerge subsequent yr as an indication that inflation is quickly returning to the ‘outdated’ regular.”

These narratives could translate into official predictions from governments and central banks, he suggested, with the U.K.’s Office for Budget Responsibility (OBR) projecting outright deflation in 2025-26 in “hanging distinction to the present market RPI fixings,” and the Bank of England forecasting considerably below-target medium-term inflation.

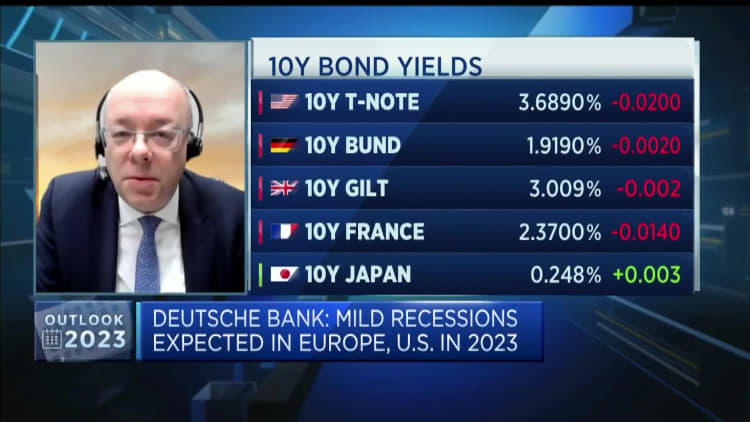

The skepticism about a return to normal inflation levels was echoed by Deutsche Bank. Chief Investment Officer Christian Nolting told CNBC last week that the market’s pricing for central bank cuts in the second half of 2023 were premature.

“Looking by our fashions, we expect sure, there’s a gentle recession, however from an inflation perspective,” we think there are second-round effects,” Nolting stated.

He pointed to the seventies as a comparable interval when the Western world was rocked by an power disaster, suggesting that second-round results of inflation arose and central banks “cut too early.”

“So from our perspective, we think inflation is going to be lower next year, but also higher than compared to previous years, so we will stay at higher levels, and from that perspective, I think central banks will stay put and not cut very fast,” Nolting added.

Reasons to be cautious

Some important worth will increase in the course of the Covid-19 pandemic had been broadly thought-about to not really be “inflation,” however a results of relative shifts reflecting particular provide and demand imbalances, and BNP Paribas believes the identical is true in reverse.

As such, disinflation or outright deflation in some areas of the economic system shouldn’t be taken as indicators of a return to the outdated inflation regime, Hollingsworth urged.

What’s extra, he instructed that firms could also be slower to regulate costs downward than they had been to extend them, given the impact of surging prices on margins over the previous 18 months.

Although items inflation will seemingly gradual, BNP Paribas sees companies inflation as stickier partially as a consequence of underlying wage pressures.

“Labour markets are historically tight and – to the extent that there has likely been a structural element to this, particularly in the U.K. and U.S. (e.g. the increase in inactivity due to long-term sickness in the UK) – we expect wage growth to stay relatively elevated by past standards,” Hollingsworth stated.

China’s Covid coverage has recaptured headlines in latest days, and shares in Hong Kong and the mainland bounced on Tuesday after Chinese well being authorities reported a latest uptick in senior vaccination charges, which is regarded by specialists as essential to reopening the economic system.

BNP Paribas tasks {that a} gradual rest of China’s zero-Covid coverage may very well be inflationary for the remainder of the world, as China has been contributing little to world provide constraints in latest months and an easing of restrictions is “unlikely to materially boost supply.”

“By contrast, a stronger recovery in Chinese demand is likely to put upward pressure on global demand (for commodities in particular) and thus, all else equal, fuel inflationary pressures,” Hollingsworth stated.

An additional contributor is the acceleration and accentuation of the developments of decarbonization and deglobalization caused by the battle in Ukraine, he added, since each are more likely to heighten medium-term inflationary pressures.

BNP maintains that the shift within the inflation regime isn’t just about the place worth will increase settle, however the volatility of inflation that might be emphasised by massive swings over the subsequent one to 2 years.

“Admittedly, we think inflation volatility is still likely to fall from its current extremely high levels. However, we do not expect it to return to the sorts of levels that characterised the ‘great moderation’,” Hollingsworth stated.