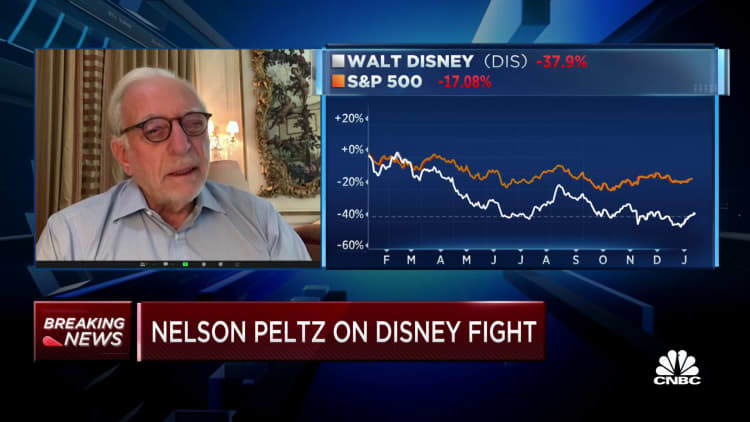

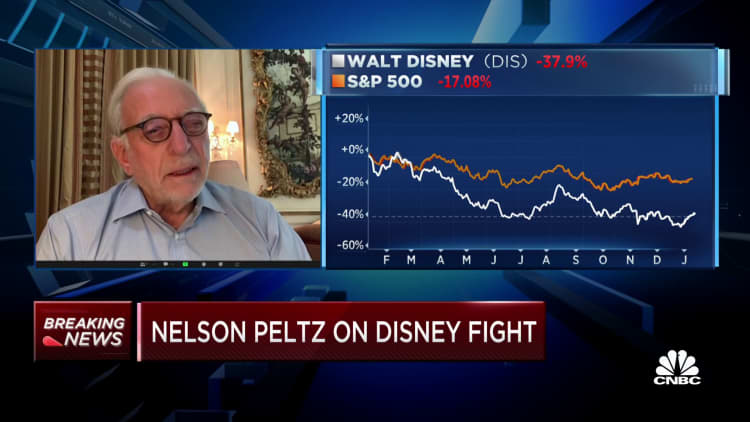

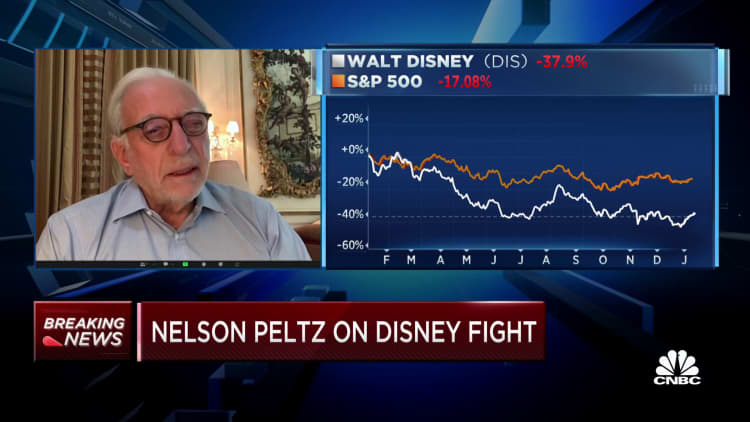

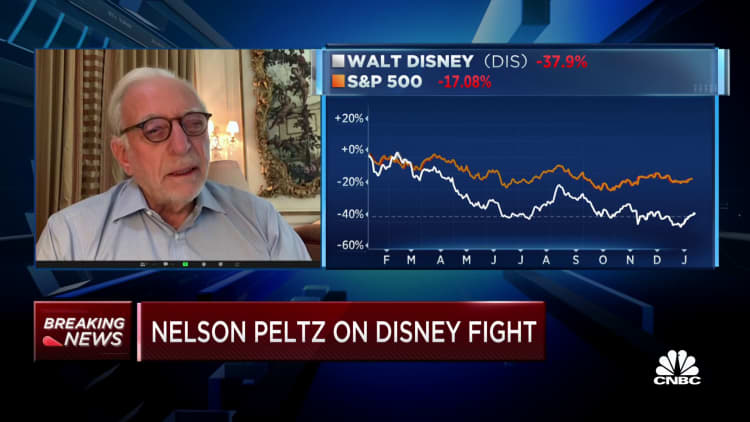

Disney is dealing with a proxy struggle as Nelson Peltz’s activist agency Trian Fund Management pushes for a seat on its board.

Peltz spoke Thursday on CNBC’s “Squawk on the Street,” making his case for the struggle his agency has picked with Disney. He raised points with Disney’s $71 billion acquisition of Fox in 2019 and the way the corporate’s shareholder worth has eroded in recent times.

“Fox hurt this company. Fox took the dividend away. Fox turned what was once a pristine balance sheet into a mess,” Peltz mentioned.

On Thursday, the activist agency filed a preliminary proxy assertion trying to put Peltz on Disney’s board.

To preempt what might be a messy proxy battle and opposing Trian, Disney on Wednesday introduced that Mark Parker, the manager chairman of Nike, would change into the brand new chairman of the board. Disney’s board will now have 11 members.

The activist agency mentioned it owns about 9.4 million shares valued at roughly $900 million, which it first accrued just a few months in the past. Trian mentioned Wednesday it believes Disney “lost its way resulting in a rapid deterioration in its financial performance.”

Peltz additionally mentioned he desires to be on the board so he can get entry to inside numbers and inform different members in the event that they’re lacking out on alternatives.

“I don’t need to overwhelm them,” Peltz informed CNBC. “I don’t need more than one person on the board.”

Shares of Disney closed up greater than 3% on Thursday.

Peltz’s grievances

Trian referred to as out what it seen as poor company governance on Disney’s half, together with failed succession planning, “over-the-top” compensation practices and Disney’s lack of engagement with Trian in current months.

In public filings Thursday, Trian listed its quite a few conferences with Disney and its board members, starting with then-CEO Bob Chapek, Peltz and their wives over lunch in July. Meetings and correspondence between Trian and Disney ramped up in frequency in November, in keeping with the submitting.

Peltz on Thursday mentioned he solely had a gathering with Disney’s board that spanned about 45 minutes however he by no means heard a response from them. A Disney consultant did not instantly reply to remark.

Peltz additionally famous that Disney was open to creating him a board observer, permitting him to take a seat in on conferences and provides recommendation on operations however with out voting privileges.

“I just need to speak reasonably to these people and explain to them where they went wrong or what opportunities they’re missing,” Peltz mentioned Thursday, noting different firms the place he is sat on the board.

People near Disney informed CNBC’s David Faber they disputed Peltz’s model, saying as a substitute the corporate supplied him the chance to enter into an information-sharing pact beneath a nondisclosure settlement, together with alternatives to fulfill with administration and the board every quarter. Disney didn’t provide him the power to take a seat in on board conferences, the folks added.

In November, Bob Iger made a stunning return to Disney’s helm, ousting Chapek — whom Iger selected as his successor — following a poor earnings report. Trian has mentioned it would not wish to change Iger, however fairly work with him to guarantee a profitable CEO transition throughout the subsequent two years.

Parker will take over as chairman from Susan Arnold and shall be tasked to steer succession planning, in keeping with Disney’s announcement Wednesday.

In Thursday’s submitting, Trian additionally referred to as out Disney’s streaming technique, saying it’s “struggling with profitability, despite reaching similar revenues as Netflix and having a significant IP advantage.” The agency additionally criticized what it believes is Disney’s lack of value self-discipline and overearning at its theme parks business to subsidize streaming losses.

Disney’s inventory had a tough 2022, popping out of the early days of the pandemic, when theme parks and film theaters had been shut down. However, as subscriber progress for streaming slowed and traders raised questions on profitability, whereas wire slicing ramped up, most media shares fell final yr.

On Thursday, Peltz mentioned Disney both must get out of the streaming business or purchase Hulu. “They must buy Hulu, that unfortunately means the company will have a debt load going forward for several years,” Peltz mentioned.

While Disney+ is the corporate’s primary play in streaming, Disney additionally owns two-thirds of Hulu and has an choice to purchase the remaining stake from Comcast as early as January 2024.

Last yr, Disney additionally introduced it might proceed with cost-cutting measures, together with a hiring freeze that Iger has upheld.

— CNBC’s David Faber contributed to this report.

Disclosure: Comcast is the father or mother firm of NBCUniversal, which owns CNBC.

Watch CNBC’s full interview with Nelson Peltz on PRO: