CNBC’s Jim Cramer mentioned Wall Street’s response Wednesday to quarterly outcomes from Nike and FedEx gives an vital lesson for traders: It’s misguided to focus purely on Federal Reserve commentary and predictions on the place S&P 500 will go subsequent.

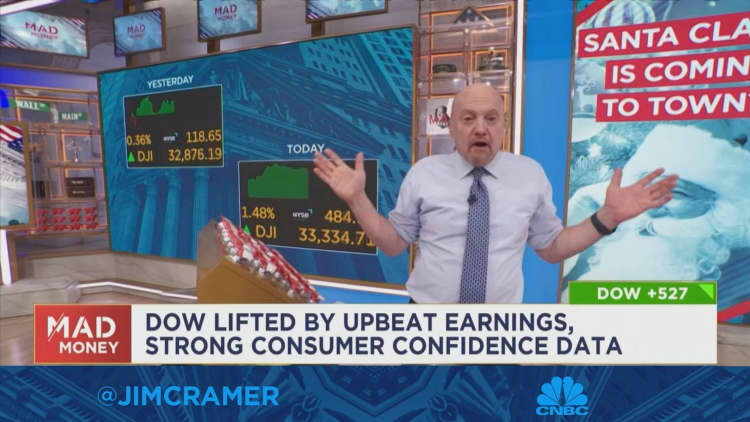

Both firms on Tuesday evening reported better-than-feared earnings, sending their respective shares increased and serving to to spice up sentiment throughout the market. All three main U.S. inventory indexes posted robust beneficial properties Wednesday, reversing a few of the declines seen in December.

“You’ve got a whole contingent of professional commentators and money managers who act like nothing matters beyond statements from the Fed and the price levels of the S&P 500,” Cramer mentioned. “See, they’re dead wrong, but that mentality explains why so few of them saw today’s rebound coming.”

Cramer mentioned it is potential the extra constructive perspective on Wednesday rapidly fades and the bearish waves rush over the market once more. He mentioned the sudden bounce — sparked largely by company earnings — reveals the advantage of specializing in particular person firms who can outperform expectations. Putting an excessive amount of emphasis on the S&P 500’s subsequent transfer could make that activity troublesome, he mentioned.

“Stocks are not just bushels of wheat or bales of hay or any other kind of grain varietal. There are huge differences between individual companies,” Cramer mentioned.