CNBC’s Jim Cramer on Friday recognized three industrial shares that he believes are value proudly owning subsequent yr, saying he expects them to outperform the sector’s prime performers in 2022.

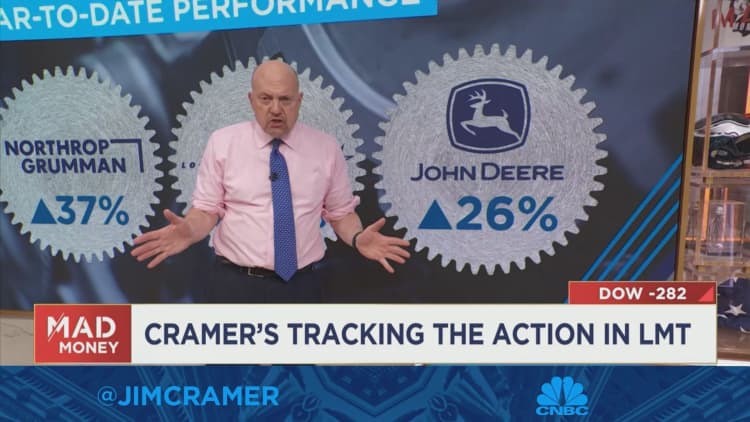

The best-performing industrial shares within the S&P 500 up to now this yr have been Northrop Grumman, Lockheed Martin and Deere — up 36.9%, 35.6% and 25.7%, respectively. Looking forward, although, Cramer stated he’d want to personal the likes of Caterpillar, Illinois Tool Works and railroad operator CSX.

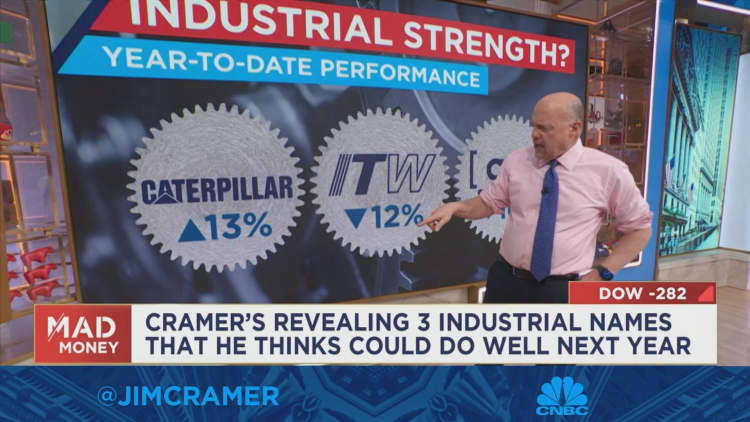

Shares of Caterpillar, which reported robust earnings two months in the past, have climbed 12.6% yr so far. Cramer stated he favors Caterpillar over fellow equipment maker Deere.

“CAT has much more exposure to infrastructure, and I think they’ve got a boost from the oil and gas industry coming,” Cramer stated. “Definitely worth owning here at 17 times earnings,” he added.

Illinois Tool Works shares are down greater than 12% in 2022 as a result of fears of an financial slowdown have trumped the corporate’s precise outcomes, Cramer contended. “I like it here, of course more [so] on a pullback,” he stated. “But I give you my blessing to buy ITW.”

Transports comparable to CSX — down practically 16% yr so far — are “totally hated” on Wall Street, Cramer acknowledged. However, he stated he believes CSX is enticing for traders with prolonged time horizons.

“For me, it’s a long-term story. I see our East Coast ports getting more business as shipping companies adjust to the fact that our West Coast ports are dysfunctional. In the meantime, CSX is just minting money with coal,” he stated. “I think it’s worth buying going into 2023.”