CNBC’s Jim Cramer on Friday provided buyers a listing of e-commerce performs he believes are value shopping for, regardless of the group’s tough efficiency in 2022.

“There are still some e-commerce plays that I’m willing to get behind here, the ones that have truly prioritized profitability,” he stated.

Here is his checklist:

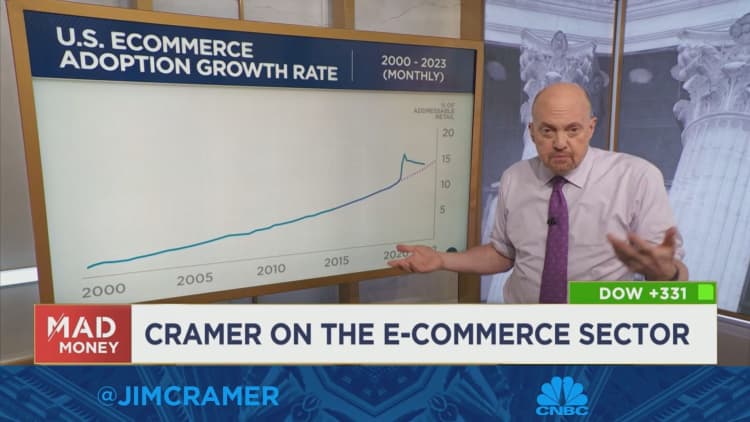

E-commerce shares skyrocketed through the peak of the Covid pandemic, as at-home customers made purchases on-line somewhat than in-store. But when the economic system reopened, customers prioritized spending on journey and experiences over items.

That shift, together with the Federal Reserve’s rate of interest hikes, despatched e-commerce shares tumbling from their highs final 12 months.

Cramer cautioned that whereas he believes the group’s struggles are momentary, it is nonetheless too early to purchase most of the names within the e-commerce house — together with Amazon.

He stated that one in all his largest considerations with the corporate is that it wants to chop extra prices. Amazon stated earlier this month that it plans to put off over 18,000 staff.

While which may seem to be a large lower, “this is a company with well over a million employees — to them, this is a drop in the bucket,” Cramer stated.

But Amazon’s inventory will finally backside, he stated. “I think the business can eventually make a big comeback and there will come a point where the stock’s a screaming buy.”

Disclaimer: Cramer’s Charitable Trust owns shares of Amazon.