Sales of current houses fell 7.7% in November in contrast with October, in accordance with the National Association of Realtors.

The seasonally adjusted annualized tempo was 4.09 million items. That is weaker than the 4.17 million items housing analysts had predicted, and it was a a lot deeper fall than normal month-to-month declines.

Sales have been down 35.4% 12 months over 12 months, marking the tenth straight month of declines. That was the weakest tempo since November 2010, apart from May 2020, when gross sales fell sharply, albeit briefly, in the course of the early days of the Covid pandemic. In November 2010, the nation was mired within the nice recession in addition to a foreclosures disaster.

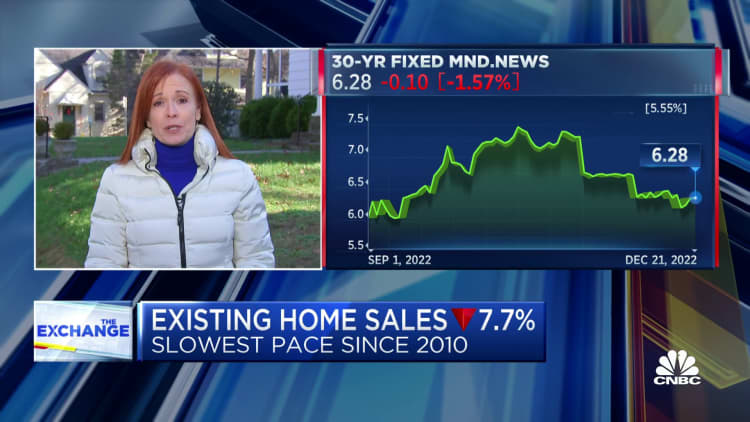

These counts are based mostly on closings, so the contracts have been seemingly signed in September and October, when mortgage charges final peaked earlier than coming down barely final month. Rates are actually about one share level decrease than they have been on the finish of October, however nonetheless just a little greater than twice what they have been at the beginning of this 12 months.

Lane Turner | The Boston Globe | Getty Images

“In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the Covid-19 economic lockdowns in 2020,” mentioned Lawrence Yun, NAR’s chief economist. “The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. Plus, available housing inventory remains near historic lows.”

Read extra: Mortgage refinance demand surged 6% final week

At the top of November there have been 1.14 million houses on the market, which is a rise of two.7% from November of final 12 months, however on the present gross sales tempo it represents a still-low 3.3 month provide.

Low provide stored costs larger than a 12 months in the past, up 3.5% to a median sale worth of $370,700, however these annual features are shrinking quick, properly off the double digit features seen earlier this 12 months. It remains to be the very best November worth the Realtors have ever recorded, and, at 129 straight months, it’s the longest working streak of year-over-year worth features for the reason that realtors started monitoring this in 1968. Roughly 23% of houses offered above listing worth, as a consequence of tight provide.

“We have seen home prices come down from their summer peaks over the past five months. At the same time, we have also seen rent growth retreat for 10 consecutive months,” wrote George Ratiu, senior economist at Realtor.com in a launch. “However, the cost of real estate remains challenging for many households looking for a place to call home, especially as high inflation and still-elevated interest rates have been eroding purchasing power.”

Sales decreased in all areas however fell hardest within the West, the place costs are the very best, down practically 46% from a 12 months in the past.

Homes sat in the marketplace longer in November, a median 24 days, up from 21 days in October and 18 days in November 2021. Despite the slower market, 61% of houses went beneath contract in lower than a month.

With costs nonetheless excessive and mortgage charges hitting a cyclical peak, first-time consumers remained on the sidelines. They have been accountable for 28% of gross sales in November, which was unchanged from October, and up barely from 26% in November 2021. Historically first-time consumers make up about 40% of the market. A separate survey from the Realtors put the annual share at 26%, the bottom since they started monitoring.

Sales fell throughout all worth classes, however took the steepest dive within the luxurious million-dollar-plus class, dropping 41% year-over-year. That sector had seen the most important acquire within the first years of the pandemic.

Mortgage charges have come off their latest highs, however it stays to be seen if will probably be sufficient to offset larger costs.

“The market may be thawing since mortgage rates have fallen for five straight weeks,” Yun added. “The average monthly mortgage payment is now almost $200 less than it was several weeks ago when interest rates reached their peak for this year.”