Bob Iger, chief government officer of The Walt Disney Co.

Patrick T. Fallon | Bloomberg | Getty Images

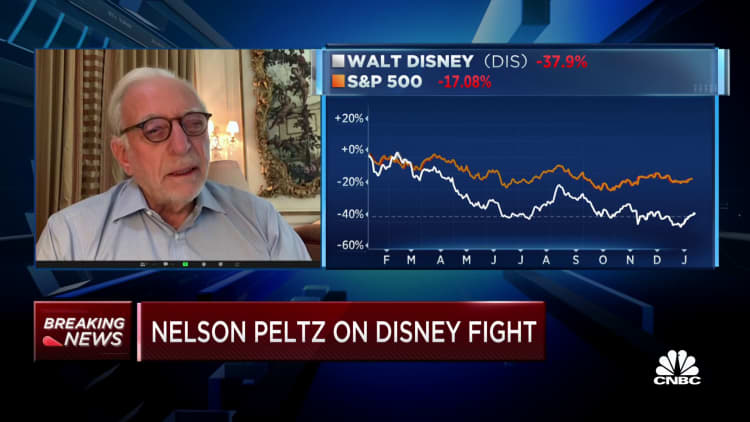

Activist investor Nelson Peltz spent about half-hour Thursday morning talking with CNBC’s Jim Cramer and David Faber in a wide-ranging interview about why he needs a Disney board seat.

But his argument barely touched on what must be his strongest level — Disney’s constant failure to plan for CEO succession.

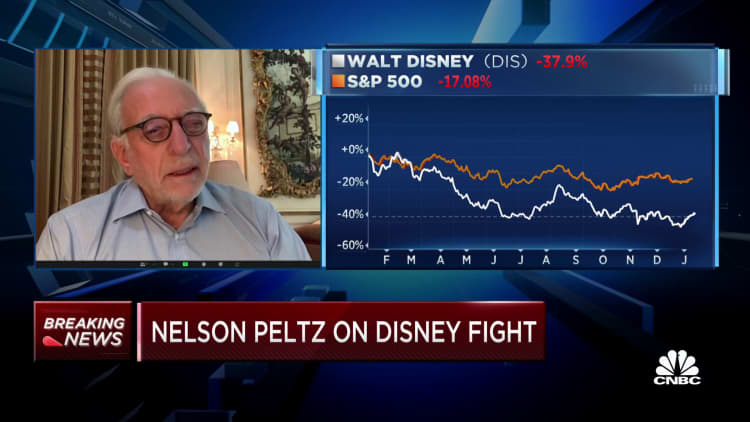

Peltz referred to his fund’s slide presentation on Disney’s failures below the management of previous CEOs Bob Iger and Bob Chapek. He stated if he needed to distill the presentation all the way down to its core, it will revolve round Disney’s poor share efficiency and Trian’s observe file of worth creation. Trian famous that Disney’s share value peaked in 2021 however at the moment trades close to its eight-year low. The inventory was up about 3% on Thursday.

But Disney’s underperformance in 2022 mirrored an industrywide stoop led by Netflix‘s stalled development. Disney’s share value spike in 2021 was brought on by the identical phenomenon — traders charging into streaming companies with important subscriber development. Disney and Netflix are each down about 38% prior to now 12 months. Other media shares are down much more. Paramount Global shares have slumped 45%. Warner Bros. Discovery shares are down nearly 50% since AT&T merged its WarnerMedia with Discovery on April 8.

Peltz stated Disney Chief Executive Bob Iger and the board overpaid for twenty first Century Fox in 2019, and he blamed that deal for the firm’s determination to scrap its dividend through the pandemic. But asking for a board seat primarily based on Iger’s observe file of acquisition decision-making is not going to win over many traders. Iger’s string of offers throughout his tenure as CEO — buying Pixar, LucasFilm and Marvel — earlier than Fox had been a number of the finest acquisitions within the historical past of the media trade.

Trian additionally known as Disney’s direct-to-consumer technique “flawed” in a submitting, “despite reaching similar revenues as Netflix and having a significant IP advantage.” Netflix launched its streaming business years earlier than Disney debuted Disney+ in 2019. It’s pure that Netflix could be forward of Disney and each different streaming service when it comes to profitability and free money move technology.

Peltz plans to mount a proxy combat, and his strongest argument to shareholders should not be about Iger’s efficiency as a CEO. Rather, it must be in regards to the board’s constant failure to plan for a post-Iger world. Iger developed a historical past throughout his preliminary, 15-year CEO tenure of chasing away potential successors, together with Jay Rasulo, Tom Staggs and Kevin Mayer. When he did hand over his CEO job in 2020, he didn’t go away the corporate utterly, establishing an 18-month stretch the place his handpicked successor, Chapek, felt undermined by his presence.

Now Iger’s again, and the Disney board has tasked him with discovering a successor within the subsequent two years. Iger’s observe file suggests succession planning is the one space the place he actually struggles.

“Iger has historically dominated the succession process, but it shouldn’t be Iger’s pick, it’s the board’s pick,” stated Charles Elson, founding director of the Weinberg Center for Corporate Governance. “Disney left itself susceptible to activist intervention because it’s had governance issues with succession for almost 25 years.”

Part of Trian’s pitch to traders is the succession problem, nevertheless it does not come up till slide 27 of a 35-slide presentation. Most of Peltz’s argument is predicated on Disney’s underwhelming share efficiency, the choice to scrap the dividend, his declare that the Fox deal hasn’t labored, how a hypothetical deal for Sky would not have labored, and Trian’s historical past of boosting share worth. He additionally instructed CNBC that Disney wanted to both purchase Comcast’s 33% stake in Hulu or “get out of the streaming business.”

Disney is addressing the share stoop of the previous yr by bringing again Iger, a CEO typically well-respected by each workers and traders. Disney may even quickly have a brand new board chairman. Peltz’s argument that Iger wants Trian’s assist with strategic decision-making simply months into stepping again into the job could also be a tough promote.

It’s a far simpler case to be made that Disney’s board and Iger have persistently bungled succession planning. Trian stated in its presentation that Disney’s shareholder engagement course of has been “among the worst (if not the worst) of all the companies we have interacted with.”

It’s potential Disney does not need Peltz on the board as a result of he’ll pressure the difficulty of succession, limiting Iger’s capability to remain as CEO longer than two years. As Trian famous in its presentation (on Slide 28), the Disney board prolonged Iger’s retirement date 5 occasions between October 2011 and December 2017.

Perhaps Peltz must refine his message to deal with that.

Disclosure: Comcast is the proprietor of NBCUniversal, guardian firm of CNBC.

WATCH: Disney is greater than a media firm, says Trian’s Nelson Peltz