CNBC’s Jim Cramer on Wednesday highlighted know-how and actual property shares he believes can carry out effectively in 2023, following a dismal yr for each sectors.

Rising rates of interest offered challenges for tech and actual property industries in 2022. Information know-how is down 27% yr thus far, as of Wednesday’s shut, whereas actual property has fallen 28.4% over the identical stretch. The solely S&P 500 sectors to carry out worse are shopper discretionary, down 36.2%, and communication providers, down 40.3%.

Cramer mentioned he believes tech and actual property will proceed to battle subsequent yr; nonetheless, tech could begin to see its fortunes enhance after the primary half of 2023.

Tech picks for 2023

Oracle’s fiscal 2023 second-quarter earnings final week have been “magnificent,” Cramer mentioned. The inventory sells for lower than 17 occasions ahead earnings. While enterprise software program is hardly Cramer’s favourite trade proper now, he mentioned Oracle’s business seems “very durable.”

Cramer mentioned he likes Broadcom’s diversification technique, together with its pending deal to accumulate VMware. Broadcom shares additionally carry a dividend yield round 3.3%, permitting buyers to be affected person whereas that acquisition goes by means of regulatory evaluation, he mentioned. The firm additionally lately introduced a $10 billion inventory buyback program.

Palo Alto Networks will not be within the S&P 500. Nonetheless, Cramer mentioned he believes it is the best-run cybersecurity firm working in an trade that has long-term endurance within the digital age. While Palo Alto Networks reported better-than-expected outcomes final month, Cramer famous the inventory is not too distant from its 52-week closing low of $142.21 on Nov. 4. “I recommend picking some up now right here and maybe some more into weakness,” he mentioned.

Real property picks for 2023

Cramer mentioned he likes Realty Income as a result of its high retail tenants — comparable to Dollar General, Walgreens and 7-Eleven — have companies that may maintain up throughout a possible recession. “Best of all, this company’s a dividend machine; they pay a monthly dividend,” he mentioned, “and tend to raise it multiple times a year. Currently, the stock yields 4.6%.”

While shares of Federal Realty have fallen round 25% in 2022, Cramer mentioned the inventory has been a stable long-term performer. Its present dividend yield is 4.25%. Cramer mentioned Federal Realty’s makes a speciality of mixed-use properties, a lot of that are in rich suburbs. That is notable given considerations round a possible recession.

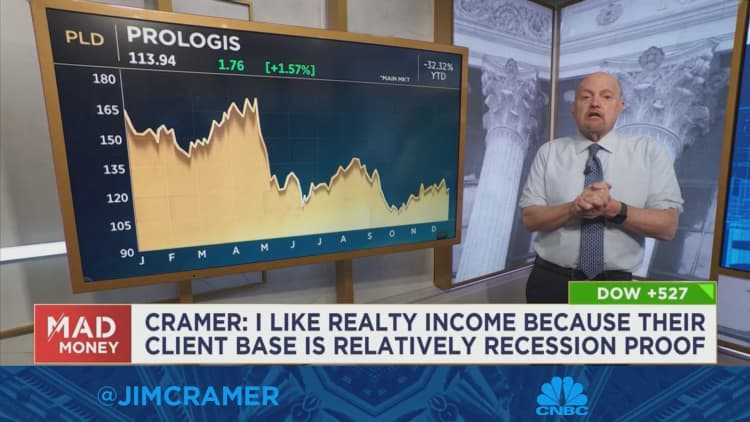

Cramer mentioned the logistics centered actual property funding belief, or REIT, has continued to show in sturdy outcomes whilst its inventory has fallen round 31% yr thus far. Cramer mentioned he thinks Prologis shares have tumbled far sufficient to start out trying attractive.