CNBC’s Jim Cramer on Monday warned traders to keep away from crypto regardless of bitcoin‘s current good points and as a substitute look to gold.

“The charts, as interpreted by Carley Garner, suggest you need to ignore the crypto cheerleaders now that bitcoin’s bouncing. And if you seriously want a real hedge against inflation or economic chaos, she says you should stick with gold. And I agree,” he mentioned.

Bitcoin continued to achieve on Monday, reaching as excessive as $23,155.93 as traders guess that the Federal Reserve will ease its tempo of rate of interest cuts or cease them altogether.

The worth of the digital forex climbed reached $23,333.83 on Saturday for the primary time since August, in line with Coin Metrics. That marks an nearly 39% climb in bitcoin for the reason that starting of this month.

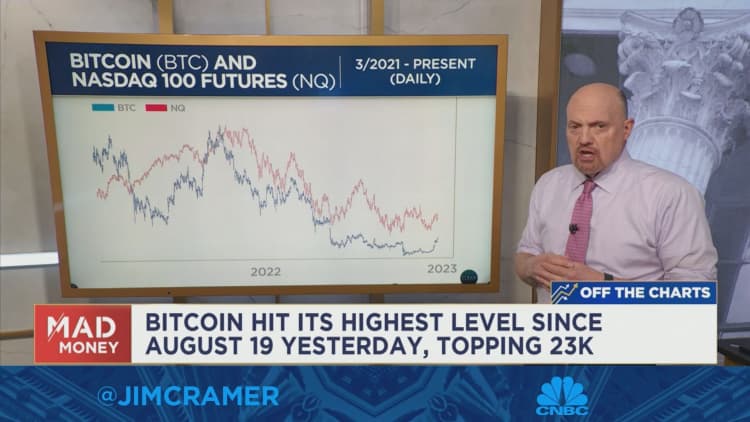

To clarify the evaluation from Garner, who’s the senior commodity market strategist and dealer at DeCarley Trading, Cramer examined the day by day chart of Bitcoin futures and the tech-heavy Nasdaq-100 going again to March 2021.

Garner identified that the 2 indexes are nearly buying and selling in lockstep, which means that it is a danger asset relatively than a forex or secure retailer maintain of worth, in line with Cramer.

“Imagine business owners trying to conduct transactions with shares of Facebook or Google … it’s ridiculous, they’re too volatile. Bitcoin is no different,” he mentioned.

The motive they commerce so intently is due to “counterparty risk,” which is the chance that the opposite social gathering in an funding or transaction may not fulfill their finish of the deal, Cramer mentioned.

“Of course, you can just own Bitcoin directly in a decentralized wallet — that protects you from counterparty risk — but if you ever want to use it for anything, the risk is back on the table. And as FTX’s prospects realized, it may be devastating,” he mentioned. “On the other hand, gold, well, it’s the opposite.”

Disclaimer: Cramer’s Charitable Trust owns shares of Meta Platforms and Alphabet.

For extra evaluation, watch Cramer’s full clarification under.