Cristiano Amon, president and CEO of Qualcomm, speaks throughout the Milken Institute Global Conference on May 2, 2022, in Beverly Hills, Calif.

Patrick T. Fallon | AFP | Getty Images

Qualcomm reported second-quarter earnings on Wednesday that have been in step with analyst expectations however noticed gross sales from handset chips, a core business for the corporate, decline 17% on an annual foundation.

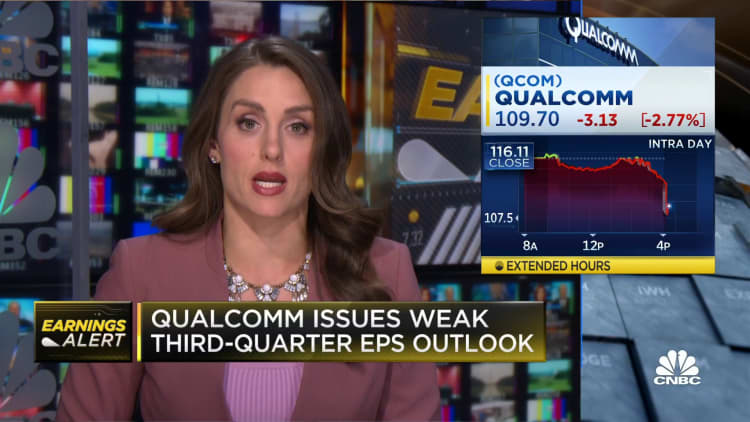

Qualcomm shares fell over 4% in prolonged buying and selling.

Here’s how the chipmaker did versus Refinitiv consensus estimates:

- EPS: $2.15 per share, adjusted, versus expectations of $2.15 per share

- Revenue: $9.27 billion, versus expectations of $9.1 billion

In the quarter ending in March, Qualcomm stated web revenue fell 42% to $1.70 billion, or $1.52 per share, from $2.93 billion, or $2.57 per share, a yr in the past.

Qualcomm stated it anticipated round $8.5 billion in gross sales within the present quarter, wanting Wall Street expectations of $9.14 billion. Analysts have been anticipating current-quarter earnings steering of $2.16 per share, however Qualcomm stated it anticipated it that to be round $1.80.

Qualcomm CEO Cristiano Amon in an announcement blamed the outcomes on a difficult setting, and the corporate stated it had not seen proof that smartphone gross sales are recovering in China. The smartphone market is taking a look at a tricky 2023, with shipments for the worldwide market declining over 14% within the first quarter, in keeping with IDC.

“The evolving macroeconomic backdrop has resulted in further demand deterioration, particularly in handsets, at a magnitude greater than we previously forecasted,” Qualcomm CEO Cristiano Amon stated on a name with analysts.

Qualcomm’s chip phase, known as QCT, sells smartphone processors, automotive chips, and different elements for superior electronics. It declined 17% to $7.94 billion in income throughout the quarter.

The largest a part of QCT’s gross sales come from handset chips, that are the processors on the coronary heart of most Android telephones. Qualcomm reported $6.11 billion in handset gross sales, down 17% from final yr.

Qualcomm stated it anticipated a larger-than-normal decline within the third-quarter for QTL income, saying that it was associated to “the timing of purchases by a modem-only handset customer.” Qualcomm not often discusses its business with Apple, and did not identify the corporate, however Apple does buy modems from the corporate for its iPhones and different units.

“Given the weaker handset forecast, until demand normalizes and visibility improves, we anticipate that customers will remain cautious with purchases,” Qualcomm CFO Akash Palkhiwala stated on the decision.

Qualcomm’s automotive business, which incorporates chips and software program for vehicles, continues to be small, though it confirmed 20% progress throughout the quarter to $447 million in income. It’s reported as a part of QTL.

Qualcomm’s licensing phase, QTL, which sells entry to applied sciences wanted for mobile service, reported an 18% annual lower in income to $1.29 billion.

Qualcomm stated it made $900 million in share repurchases and paid $800 million in dividends throughout the quarter.

Source: www.cnbc.com