CNBC’s Jim Cramer informed traders to not discard their conventional, regular shares after Tuesday’s buying and selling session.

“It is so easy to panic out of stocks on the first sign of weakness,” he mentioned, including, “I’m urging the opposite.”

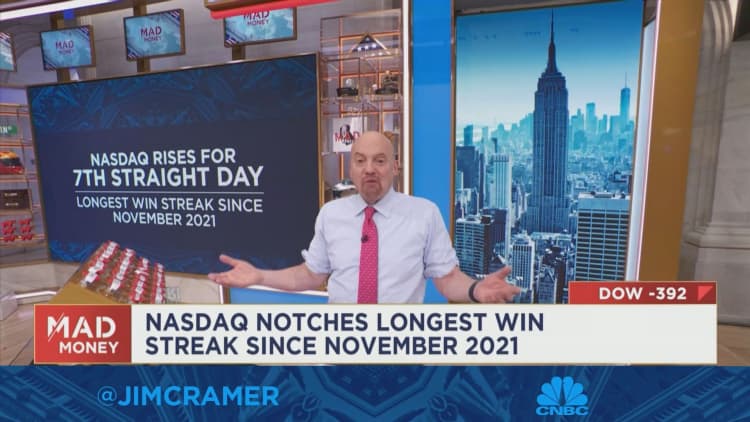

The Dow Jones Industrial Average and S&P 500 fell on Tuesday on the again of weaker-than-expected financial institution earnings, which ended a four-day successful streak. The Nasdaq Composite was the one main index to finish up on the day.

So far, the tech-heavy Nasdaq is main the best way 12 months so far at 6.01%, with positive factors pushed by Wall Street’s hopes that indicators of softening inflation means a greater 12 months is in retailer for progress shares.

Cramer reiterated his stance that traders should not rush into tech shares, warning that almost all firms have not taken the cost-reduction steps mandatory for his or her shares’ latest runs to be sustainable.

He added that Tuesday’s losses symbolize a shopping for alternative for an additional group of shares.

“I remain more partial to those traditional cyclical stocks. You’re getting a chance to buy them ahead of what I believe will be better earnings comparisons than you’re going to see from tech,” he mentioned.