CNBC’s Jim Cramer on Wednesday stated that the markets’ latest positive factors might turn out to be a sustained rally.

“The charts, as interpreted by Larry Williams … suggest that the market could have a very nice run over the next couple of months,” he stated.

Stocks rose on Wednesday, persevering with the yr’s robust begin as buyers grew assured that the Federal Reserve is successful its battle towards inflation. All three main indexes closed up, with the Nasdaq Composite notching its fourth day of positive factors.

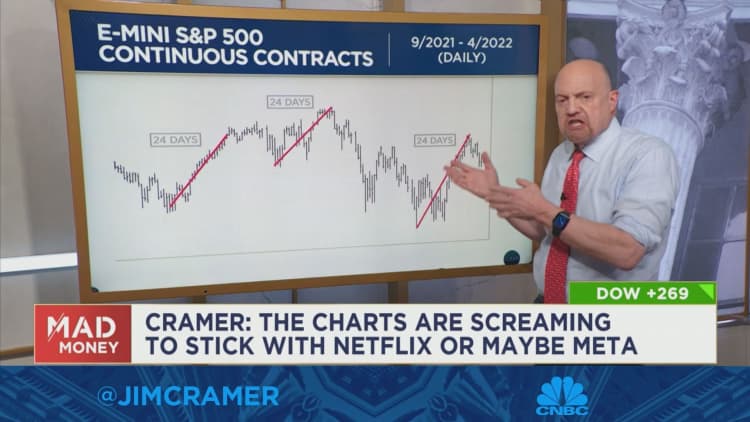

To clarify Williams’ evaluation, Cramer examined the each day chart of the S&P 500 from late 2021 to early 2022.

Cramer stated that each main rally throughout this era lasted for twenty-four days, in keeping with Williams. He added that this sample continued throughout the second half of 2022, with 24-day rallies in July, August and from mid-October to mid-November.

This week marked a brand new rally and will proceed till February 3 if the sample holds — and even previous that date, Cramer stated.

“Williams thinks we’re in the early, choppy phases of a bull market. To him, most of the bad news already got baked in last year, which sets us up for a better time in 2023,” he stated.

For extra evaluation, watch Cramer’s full clarification beneath.