CNBC’s Jim Cramer on Tuesday stated that sure commodities might make a comeback quickly.

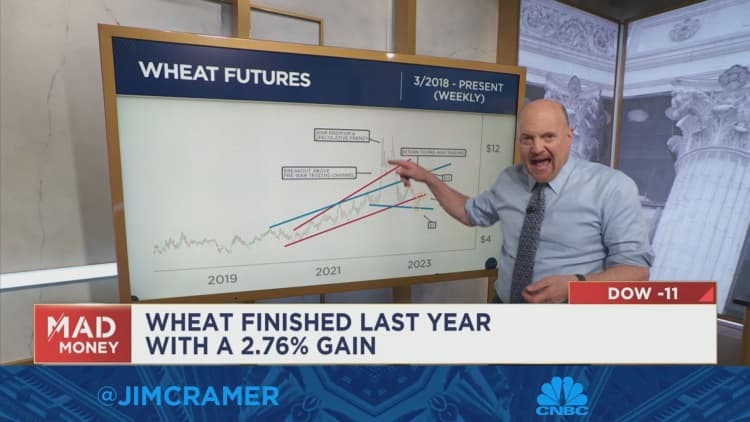

“The charts, as interpreted by Carley Garner, tell us that the boom and bust cycle in commodities never stops, and right now that’s good news for oil, … natural gas and wheat prices,” he stated.

Commodities markets had been risky final yr as Russia’s invasion of Ukraine, financial points within the U.S. and China and hostile climate shook investor sentiment and diminished provide. Prices of oil, pure fuel and wheat roared greater within the first half of the yr however stabilized considerably within the later half because the Federal Reserve raised rates of interest and pandemic-driven provide snags resolved.

To clarify Garner’s evaluation, Cramer examined the weekly chart of West Texas Intermediate crude, the U.S. benchmark for oil.

He identified that Garner was adamant final yr that oil would return to its earlier buying and selling vary as soon as sanctioned Russian oil was rerouted to India and China, and the chart exhibits that her prediction got here true.

Cramer added that she expects oil this yr to maneuver between $65 to $70 a barrel on the low finish, and to maybe the mid-$90s and low $100s on the excessive finish.

“She expects this channel to be resilient, and that is why she recommends buying the dips,” he stated.

For extra evaluation, watch Cramer’s full rationalization beneath.