More than half of logistics managers at main corporations and commerce teams say they don’t anticipate the provision chain to return to regular till 2024 or after, in line with a brand new CNBC survey.

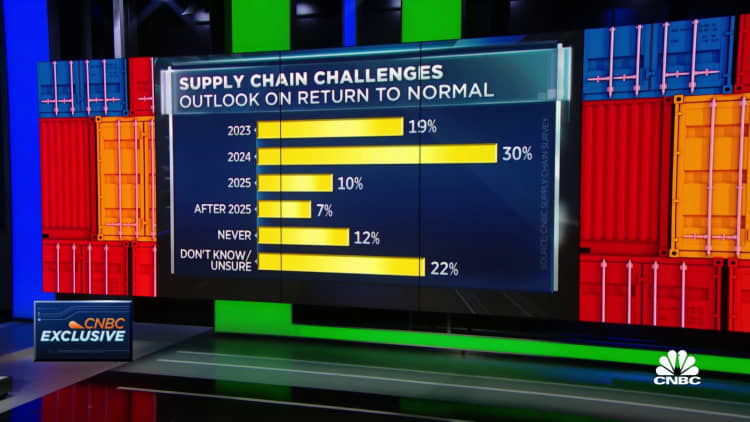

Sixty-one p.c of respondents mentioned their present provide chain will not be working usually, in contrast with 32% that mentioned it’s functioning usually. When questioned after they see a return to normalcy, 22% have been not sure, 19% mentioned 2023, and 30% mentioned 2024.

Another 29% mentioned in or after 2025, or by no means.

The dour outlook comes after nearly three years of worldwide provide chain issues, which started with the shutdown of Wuhan, China, the place the Covid outbreak started. Survey respondents mentioned they’re nonetheless putting orders six months upfront to make sure their arrival.

The survey questioned 341 logistic managers the week of Dec. 12-19 at corporations which might be members of the National Retail Federation, the American Apparel and Footwear Association, the Council Of Supply Chain Management Professionals, the Pacific Coast Council, the Agriculture Transportation Coalition and the Coalition Of New England Companies For Trade participated in first provide chain survey by CNBC.

Data sharing

When requested in the event that they believed the Biden administration understood the challenges the provision chain was going through, 59% of respondents mentioned it didn’t.

Jon Gold, vice chairman of provide chain and customs coverage of the NRF, mentioned the administration has taken steps to deal with the provision chain challenges.

Earlier this yr, for instance, the administration rolled out a pilot provide chain information sharing program known as Freight Logistics Optimization Works, or FLOW. The Department of Transportation informed CNBC there are presently 46 members in this system.

“The administration needs to remain focused and continue to convene the right supply chain stakeholders to discuss ways to improve supply chain operations and expand data sharing to create a truly 21st century supply chain,” Gold mentioned.

Eduardo Acosta, president of the Pacific Coast Council of Customs Brokers and Freight Forwarders Association, additionally weighed in on the necessity for extra reform.

“The carriers have arbitrarily imposed such charges on customs brokers, even though we may not have had any role in booking or managing the transportation,” he mentioned. “The survey provides data supporting the imperative for the Federal Maritime Commission to advance its proposed rule to end this unreasonable carrier practice.”

Fifty-one p.c of logistics managers surveyed mentioned they didn’t imagine a nationwide provide chain information base could be created, whereas 22% mentioned they did and 27% mentioned they have been not sure.

Both logistics managers and authorities officers have mentioned information sharing would expedite the motion of freight, serving to scale back prices and creating financial savings that may very well be handed onto the buyer.

“Hard data is the backbone of effective supply chain management, especially amidst the uncertainty shown in this survey,” Karen Kenney chair of CONECT. “Intelligence about real time cargo flows is essential. The survey highlights the need for the industry to rally around better data sharing solutions.”

Nate Herman, AAFA’s senior vice chairman, of coverage informed CNBC the issues that created the provision chain disaster are removed from over.

“Now is the time to double down on bringing all stakeholders together to create and implement real solutions to structural problems so that we don’t end up skipping from crisis to crisis,” he mentioned.

Clearing warehouses

Among the largest challenges cited by logistics managers famous within the survey have been the dearth of availability of uncooked supplies, port congestion, a scarcity of expert employees and dwindling warehouse house due to hovering inventories. Also cited have been terminal guidelines on selecting up and dropping off containers and canceled sailings.

Bloated inventories have stored warehouses packed, and respondents mentioned they noticed a 400% improve in warehouse costs as house decreases. That is benefitting shoppers, with who’re selecting up closely discounted gadgets as retailers attempt to transfer out product out of the warehouses.

Scott Sureddin, CEO of DHL Supply Chain, mentioned freight volumes have been flat after Cyber Week however at the moment are up 10% from a yr in the past as retailers slash costs to clear stock.

“Customers are shopping discounts and we are seeing that in the items we are moving. It’s the higher value products like tennis shoes over a lower cost t-shirt, he said. “I’ve by no means seen stock ranges like this and after the primary of the yr, retailers cannot proceed to take a seat on this stock so the reductions they have been pushing should proceed.”

Inflationary, labor pressures

Energy prices and labor are two inflationary pressures respondents said are still driving up logistic costs. Russia’s war on Ukraine followed by tariffs imposed during the Trump administration were the top geo-political events impacting the supply chain, followed by Covid.

On the labor front, respondents said they were worried about the mental health of their workforce as well as the shortage of skilled workers, which is adding to the stress. Survey results cited these as problems: employee burn out (65%), shortage of employees with the right skills (61%) and hiring to address the skills gap (75%).

“International logistics remains to be a business pushed by folks,” said Kenney of CONECT. “The survey highlights all kinds of challenges within the provide chain, however none of these will get solved with out the correct expertise and experience.”