When they began out within the ’90s, David Sharpe and Natasha Hilfer had been each each fiercely sensible and exceedingly bold, with eyes on the finance sector. But each believed they needed to overcome, as David as soon as mentioned, the implicit need-not-apply signal Bay Street hung to push back anybody who was totally different. Natasha, who holds an MBA from the Rotman School of Management, needed to battle the outdated boys’ membership. David, in the meantime, who’s Mohawk and a member of the Tyendinaga First Nation, felt he needed to cover the truth that he’s Indigenous. He would repeatedly say that, for the primary 15 years of his profession, he refused to acknowledge his roots to anyone he labored with: “Because,” as he put it, “I wanted to grab power.”

The pair married in 1996 and shortly made it on Bay Street. David graduated from Queen’s University with a legislation diploma, received his Master of Laws at Osgoode Hall after which earned his MBA from Ivey Business School. From there, he labored because the chief compliance officer at a number of corporations, together with Citigroup and CI Financial, and served as director of investigations on the Mutual Fund Dealers Association. Natasha Sharpe earned a glowing popularity as a danger knowledgeable on the Bank of Montreal. After the devastating 2008 recession, Sun Life Financial wooed her into changing into its first-ever chief credit score danger officer; she was answerable for creating the corporate’s danger coverage for its $110 billion in managed belongings.

After solely two years at Sun Life, Natasha left to begin her personal firm in 2012, securing financing from a pal, Jenny Coco. Natasha believed her new agency might deal with a spot within the post-recession lending market, doling out loans to Canadian firms that couldn’t safe the required money to do issues like purchase stock, meet capital expenditures or restructure debt. She named the corporate Bridging Finance, a nod to its position as a figurative bridge, and shortly hitched her skilled star to her husband’s, hiring him because the COO.

Over the subsequent decade, the Sharpes turned Bridging right into a Bay Street darling. Every main financial institution and unbiased brokerage within the nation made its personal debt fund eligible on the market. Bridging specialised in two sorts of lending methods: factoring and asset-based. The first concerned shopping for accounts receivables from mom-and-pop retailers in want of a fast money infusion. Take, for instance, a jeweller that landed an enormous contract with a nationwide retail chain—a superb factor, besides it could instantly have to finance elevated manufacturing. Bridging would purchase the jeweller’s accounts receivable at a reduction, then accumulate in full when the retailer paid Bridging. Asset-based lending, however, concerned loaning cash to much less established firms, charging sky-high rates of interest and ruthlessly amassing collateral if issues went flawed. With purported annual returns of between seven and 9 per cent by 2014, the Sharpes appeared to have conquered danger itself.

In 2016, David and Natasha shuffled positions; he grew to become CEO, and she or he centered on her position as chief funding officer. By early 2020, Bridging had some 20,000 traders and $1.6 billion in belongings below administration. But few suspected that the Sharpes’ glittering, feel-good empire might need been constructed on lies. Today, the Ontario Securities Commission (OSC) has implicated Bridging in an enormous and sophisticated internet of alleged misappropriation and fraud, and the Sharpes are on the centre of an unprecedented months-long listening to in entrance of the Capital Markets Tribunal. If the OSC’s case towards them succeeds, the pair will probably be remembered because the joint architects of one of the vital audacious frauds in Canadian historical past.

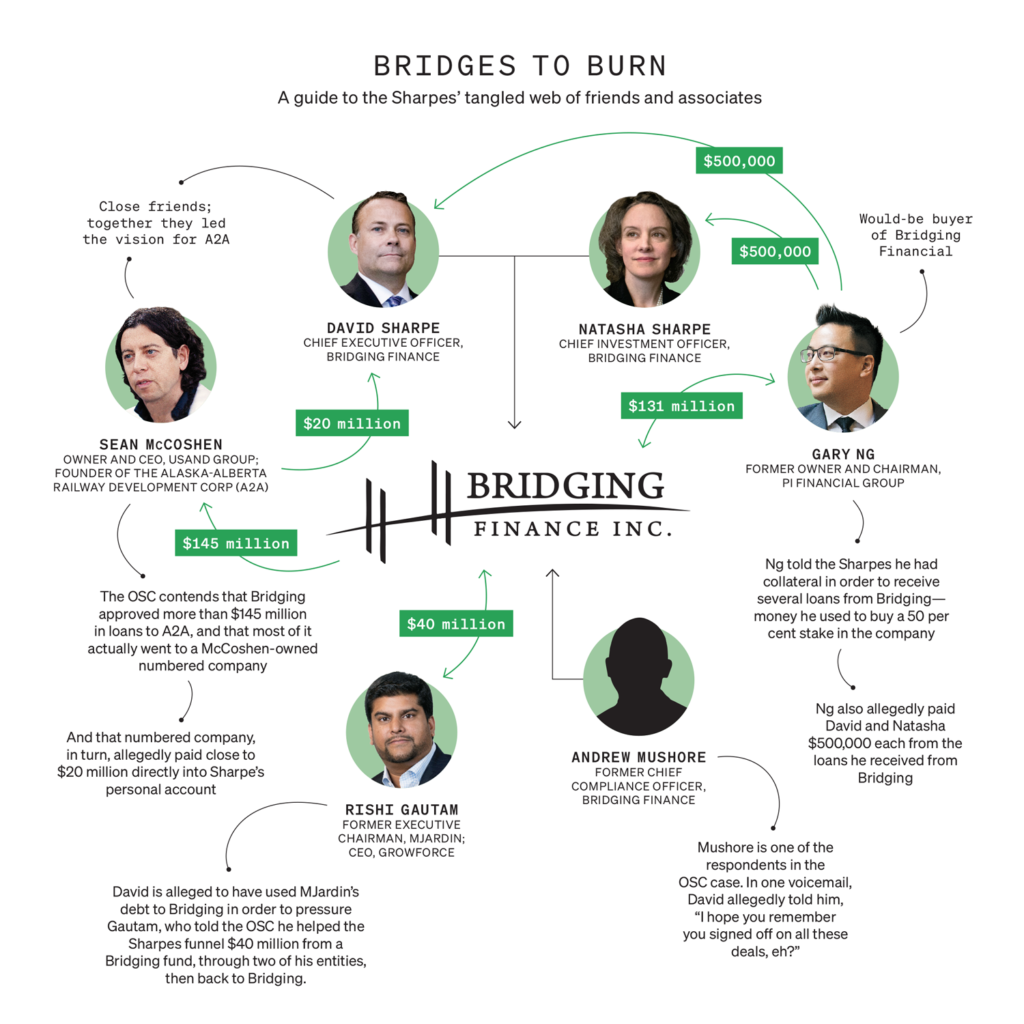

A few years earlier than David was promoted to CEO of Bridging, he met a Winnipeg finance man named Sean McCoshen. The two males rapidly grew to become shut business allies. The method McCoshen advised it, he was an funding banker who’d spent three years working in Dubai with a multinational private-equity agency to construct a billion-dollar grain terminal. He claimed the venture required in depth session with native Bedouin tribes, as a result of it infringed on their conventional land. When he received again to Canada, he began an organization, The Usand Group, to assist First Nations safe financing for housing and different infrastructure initiatives. His purported mission little question appealed to David, who quickly sunk tens of millions of Bridging {dollars} into McCoshen’s initiatives.

In 2017, Bridging made a $30-million mortgage to Peguis First Nation, an Indigenous group of about 10,000 folks in Manitoba, about 190 kilometres north of Winnipeg. McCoshen, who had a pre-existing business relationship with Peguis, helped dealer the deal, telling David that the group wanted cash to deal with a housing scarcity and lack of job alternatives. (Unlike David, Sean McCoshen has no Indigenous ancestry.) The downside was, the Bridging mortgage breached the circumstances of the Bank of Montreal financing McCoshen had beforehand secured for the group, triggering a direct demand for reimbursement. Peguis was pressured to safe a second $30-million Bridging mortgage to pay BMO, and McCoshen earned $7.2 million from Peguis for facilitating the offers. By early 2022, Peguis was greater than $140 million within the gap. As Peguis continued to fall behind, Bridging’s punishing rates of interest solely tunnelled the group additional into debt.

Related: VC Funds Are Dominated by Men. These Women-Led Firms Are Trying to Change That

None of this stopped David Sharpe and McCoshen from partnering on a fair larger enterprise: an bold Alberta-to-Alaska railway venture usually known as A2A. McCoshen’s crown jewel, the railway was meant to attach Fort McMurray to ports in Alaska, opening up Alberta oil to the worldwide market whereas additionally permitting Indigenous communities to rake in money by a 49 per cent possession stake. Over six years, A2A borrowed at the very least $145 million from Bridging. Somewhere alongside the best way, McCoshen began describing David because the venture’s co-founder, and, in time, Bridging secured a $109-million fairness stake within the railway’s guardian firm. The two buddies even travelled collectively in 2019 to pitch the $22-billion venture to Mike Pence, efficiently acquiring the required permits from U.S. officers. One paper in Alaska speculated that McCoshen was the area’s saviour.

As David grew extra highly effective on Bay Street, he started embracing his Indigenous heritage and giving again to the group. In 2017, he donated $50,000 to Queen’s University so his alma mater might begin the David Sharpe Indigenous Law Student Award. The subsequent 12 months, he donated one other $100,000 towards a brand new bursary, adopted by $250,000 for the varsity to begin an Indigenous Knowledge Initiative. He joined the board of trustees at Queen’s, grew to become an envoy for Queen’s Law, taught an Indigenous legislation class and sat because the chair of the First Nations University of Canada. Several individuals who labored with David at the moment described him as great, freely sharing his experience and genuinely invested in serving to different Indigenous folks succeed. As one former board member put it, “He was the whole package: He had the success, financially and reputation-wise, and the movie-star good looks.”

David’s public generosity, and the doorways it opened, legitimized his standing on Bay Street—and coincided with Bridging hitting $1 billion in belongings below administration. David celebrated at a bar adorned with big gold balloons that spelled out “$1BN.” In 2020, the Association of Fundraising Professionals dubbed him one in all its excellent philanthropists of the 12 months. Upon listening to the news, a professor at Queen’s gushed that David was merely the kind of one who opened his chequebook and received stuff performed.

But not all was effectively with McCoshen. Despite his stylings as a monetary wizard, his previous included a historical past of flirting the catastrophe line together with his personal private funds and a collection of accusations of receiving monetary kickbacks. In 2016, APTN reported accusations towards his agency, The Usand Group, by two First Nations chiefs who mentioned that senior execs on the firm had supplied them cash to rent Usand to be able to safe loans for his or her communities. In trade for each kickbacks and the loans, Usand charged exorbitant charges. At allegedly the time, Usand had already organized about $113 million of financing with First Nations teams; it was aiming to triple that quantity. (McCoshen didn’t reply to interview requests for this story.)

David’s public generosity, and the doorways it opened, legitimized his standing on Bay Street—and coincided with Bridging hitting $1 billion in belongings below administration

If the Sharpes noticed warning indicators, they ignored them. Instead, it seems, they noticed alternative. With McCoshen by their facet, their success solely appeared to develop. But in actuality, the OSC alleges, a lot of Bridging’s triumph was a ruse. In the autumn 2018, for instance, Bridging introduced that it had purchased out one in all its companions, Ninepoint Financial, which had, till then, co-owned and co-managed one in all Bridging’s funding funds. The OSC means that Bridging needed out of the partnership as a result of Ninepoint executives had began to suspect one thing was fishy concerning the cash shifting out and in of the fund. To pull off the acquisition, David allegedly pressured Rishi Gautam, the pinnacle of MJardin, a hashish firm that owed Bridging $80 million, right into a “back-to-back loan.” Gautam later advised OSC investigators he agreed as a result of he felt he wasn’t able to say no. And so, the Sharpes allegedly misappropriated roughly $40 million from a Bridging fund and loaned it to one in all Gautam’s entities, River City Investments. In flip, a second Gautam-controlled entity, 3319891 Nova Scotia, loaned it again to Bridging. Then, the OSC says, they obscured the mortgage’s true origins and celebrated what they known as a “great milestone.”

Bay Street’s conservative popularity is etched in buttoned-up gray fits. But, for all its calculation and technique, the high-stakes monetary world additionally thrives on theatre. It is filled with massive, schmoozy personalities, lots of them residing embodiments of faux it ’til you make it. A superb salesperson wants a sure alchemy of bluster, allure and guts. CEOs achieve reputations, allies and fortunes by advertising themselves as a lot as their firm’s services or products. Confidence is anticipated; cockiness is welcome.

In 2019, the Sharpes grew to become acquainted with Gary Ng, a younger upstart who, like them, was conversant in Bay Street’s tradition of brash ostentation. But neither of the Sharpes had something on Ng’s capacity to placed on a present. Ng’s popularity prospered on self-mythologizing: that he was, as one publication later dubbed him, a monetary “whiz kid” and—as he put it himself—Bay Street’s “succession plan.” As Ng would confidently say greater than as soon as, to media and on his personal web site, chaos breeds alternative. He was definitely adept at creating each.

When Ng burst onto the scene in 2018, he had his story prepared. He advised folks that he’d develop into an “internet millionaire” at age 16 and that he took that cash and put it right into a glass manufacturing unit in China, which he offered for a $150-million revenue. Then, he says, he mastered golf. Somewhere in his spare time, he says, he additionally served within the navy. By 2008, he was a futures dealer in Winnipeg, his hometown, and, in line with him, rapidly grew to become the agency’s finest. Next, at age 28, he acquired a small Toronto brokerage and renamed it Chippingham Financial Group. Then, at age 34, he purchased PI Financial, one in all Canada’s greatest funding corporations, in an all-cash $100-million buy. In one interview, he bragged, “I’ve been told I’m the most powerful man on Bay Street now that nobody’s ever heard of.”

Related: How a Government Worker Extorted Millions From Canadian Businesses

As his profile grew, Ng known as himself an “admiral” who was working to amass a fleet of unbiased corporations. He needed ones centered on fairness, buying and selling, wealth administration and, fortuitously for the Sharpes, debt. In 2019, he advised the media that he needed to extend his belongings to $50 billion in simply three years. “Given his track record,” wrote a BNN Bloomberg journalist, “you wouldn’t want to doubt him.” Yet Ng’s monitor file invited doubt. Chippingham was, in reality, combating insolvency and mired in authorized battles. The Investment Industry Regulatory Organization of Canada (IIROC) accepted the PI transaction, partly as a result of it hoped that by forcing PI to inherit Chippingham’s shoppers, it might save the agency from catastrophe. Ng wasn’t a monetary whiz child; he was struggling to maintain his fleet afloat. Still, he needed to purchase Bridging, and he was ready to pay $50 million to accumulate a 50 per cent, non-controlling stake in it. Or, fairly, he appeared ready to fake he would shell out the money.

It’s unclear if the Sharpes knew the extent of his alleged lies—they later claimed to be shocked by the subterfuge. Either method, the couple seems to have helped facilitate at the very least a few of Ng’s fantasy dealings. Here’s what the OSC says occurred. After Ng expressed curiosity in buying Bridging, it loaned his firms about $50 million from its investor funds—cash Ng then used, partly, to fund the acquisition. After the deal was signed, Bridging loaned him one other $32 million in June 2019. Then, the OSC says, a month later, Ng begged the Sharpes to instantly “upsize” his mortgage with one other $35 million, which they did. They gave one in all his firms one other $2 million in October, and, shortly after, they every acquired $500,000 from Ng. Another $10 million went to Ng’s firms in February 2020. All potential loans from Bridging’s funds had been meant to be accepted by an eight-member credit score committee—of which the Sharpes had been a component—however the OSC says that the Sharpes fudged sure particulars or outright hid lots of Bridging’s shady loans, corresponding to these given to Ng. As a assure towards all of this, Ng advised David and Natasha that he had an funding account price roughly $90 million. It didn’t exist.

In the tip, PI’s basic counsel, Richard Thomas, realized one thing was amiss and alerted the IIROC to his suspicions that Ng had reported a false funding account. Soon, Ng’s rigorously crafted picture started to unspool. The IIROC’s investigation concluded that Ng, together with one in all his colleagues, had procured $172 million in loans, all on the premise of falsified collateral data. The organiation says he’d create model new accounts after which grossly falsify their balances: He mentioned one had a market worth of greater than $20.6 million and one other greater than $90 million when, in actuality, they’d a steadiness of $0 and $4, respectively. In different circumstances, says IIROC, he took present accounts—belonging to his shoppers—and altered the paperwork to make it appear to be the accounts belonged to him. Altogether, he created tens of millions in fictitious belongings. (He didn’t reply to interview requests for this story.)

As a assure towards all of this, Ng advised David and Natasha that he had an funding account price roughly $90 million. It didn’t exist.

David and Natasha caught wind of the accusations towards Ng in early 2020 and confronted him, secretly recording the dialog. They say he admitted to all of it. By the time the story broke, they appeared to have distanced themselves from Ng. Earlier media reviews introduced Bridging as simply one other agency Ng had fooled, a job the Sharpes appeared desirous to play. At the identical time, they will need to have feared that regulators would look too intently at their very own books—and study that Ng wasn’t a grievous mistake however fairly one a part of a sample of obvious below-board dealings that appeared to increase far past him.

Long earlier than the investigation into the Sharpes’ former business companion was introduced, a monetary guide residing in Montreal named Alejandro Cardot started to suspect Canada’s personal debt business was a sham. One of his kinfolk had requested him for recommendation on whether or not to spend money on personal debt funds. Unsure, Cardot dug round for data, ultimately discovering Bridging. There was lots concerning the firm, he thought, that didn’t add up. To Cardot, Bridging’s claims of regular, fixed returns didn’t make sense: It specialised in loaning cash to firms that had been too unstable to safe money from the banks. Some of these loans, he figured had been certain to go flawed and negatively have an effect on Bridging.

Related: Scammers Are Posing as Recruiters on LinkedIn and Swindling Job Seekers

In time, Cardot discovered precisely what he anticipated: Many of the businesses Bridging had granted tens of millions to had gone spectacularly belly-up. Hygea, which described itself as a health-care holding firm, owed Bridging greater than US$122.5 million by the point it went bankrupt in early 2020; it represented at the very least 15 per cent of Bridging’s belongings. Yet, Bridging didn’t write off the loss, nor did its returns appear to be affected in any respect. Cardot found repeated cases of firms being unable to pay again tens of millions in Bridging loans. He was shocked that no one else appeared to have caught on—that, in truth, Bridging was celebrated. He gathered all his analysis into one doc and filed a whistle-blower report with the OSC. In it, he warned: “The pressure to keep making the numbers and monthly distributions will push Bridging to even more deceit. Until one morning we will wake up and the house of cards will have fallen.”

Cardot couldn’t have identified that the OSC was already constructing its personal case. It alleged that, collectively, the Sharpes and McCoshen engaged in their very own kickback scheme, orchestrating the key switch of tens of millions of {dollars} from Bridging’s funding funds into their very own pockets. The OSC believes many of the cash Bridging mentioned it superior to A2A truly went to 7047747 Manitoba Ltd., a McCoshen firm. Through a collection of 14 transfers between 2016 and 2019, McCoshen and his numbered firm are alleged to have funnelled near $20 million again to David.

Most of the funds, it seems, landed in David’s private chequing account mere days after McCoshen or one in all his firms acquired mortgage funds from Bridging. More than half allegedly went into his funding accounts, whereas one other couple million went into his private banking accounts. The Sharpes spent greater than $225,000 on automobiles, shopping for a Tesla and leasing two Bentleys. They accomplished almost $2 million in renovations on their Toronto dwelling. The OSC believes that among the cash went into Natasha’s account, and a few went to sure Bridging workers—those that allegedly knew of, or helped cowl up, the Sharpes’ supposed misdeeds. Rounding out the OSC allegations: the obvious misappropriation of funds involving loans to Ng and people by Gautam’s entities.

“The pressure to keep making the numbers and monthly distributions will push Bridging to even more deceit. Until one morning we will wake up and the house of cards will have fallen.”

In the early months of 2020, investigators say, the Sharpes scrambled to cowl up their very own fraud, doctoring dozens of paperwork and concealing the true nature of their bogus loans. But the partitions had been closing in. In September 2020, the Sharpes realized the OSC needed to query them the next month. Likely petrified of what the OSC would unearth, David allegedly directed a Bridging worker to work with the corporate’s third-party IT staff to completely delete hundreds of emails on Bridging’s server. He supplied an inventory of 18 probably incriminating search phrases, together with “Sean McCoshen” and his numbered firm, “7047747 Manitoba Ltd.” Once the duty was full, roughly 34,200 emails on Bridging’s servers had vanished. The fee says David requested the worker to carry out one other search in March 2021, utilizing among the similar phrases, earlier than his second interview with the OSC a couple of weeks later.

OSC investigators questioned David over video. (Natasha didn’t be a part of the decision.) He denied any wrongdoing, claiming to know (or keep in mind) little or no concerning the internal workings of the corporate he ran. For hours, the 2 investigators requested David about Bridging’s extra questionable loans, with many of the interrogation centring on Peguis, McCoshen and Ng. Initially, he advised the investigators that he’d had no monetary dealings with McCoshen past the loans Bridging had superior for the A2A venture; he portrayed them as respectable. When investigators ultimately confirmed him documentation that appeared to show the cash path from 7047747 Manitoba again to David’s private account, he mentioned the close to–$20 million he’d acquired from McCoshen had been loans for private investments. Investigators identified the suspicious timing of the loans. “It certainly does not look good,” David acknowledged. “That’s for sure.”

Related: Hydro-Québec’s Billion-Dollar Power Struggle

Yet he nonetheless refused to confess he’d performed something flawed. He claimed to have a tough copy of a mortgage settlement between him and McCoshen at Bridging’s places of work. Investigators demanded that he produce it by 5 p.m. that day. When his lawyer pushed again towards the urgency, investigators responded that they didn’t need to give David time to physician any paperwork.

At 8:14 p.m. that evening, David’s legal professionals emailed the OSC to say he had searched his workplace at Bridging however couldn’t discover the mortgage settlement. The subsequent morning, the OSC requested the Ontario courts to place Bridging below receivership— not as a result of the corporate was bancrupt however as a result of the fee believed the Sharpes couldn’t be trusted to run it. The transfer, it argued, would shield each Bridging’s traders and the general public. The courts granted the appliance that day, and management of Bridging was handed over to PricewaterhouseCoopers. Within per week, each Sharpes had been fired. David, by and huge, caught to the story he advised the OSC. He expressed to media that he thought the fee had gone too far. “The need to put in a receiver is perplexing,” he mentioned. “We are stunned by this.” Cardot, in the meantime, felt vindicated. “I was at my kid’s soccer game when I heard about the receivership,” he advised me. “And I thought, ‘Wow, I wasn’t crazy.’”

As sanguine—and shocked—as David might have appeared, the OSC alleges he launched into a sample of behaviour designed to cover his tracks. During the summer season, in line with proof introduced by the OSC, David started to threaten Bridging workers towards speaking. The OSC says he texted and known as folks, leaving profanity-laden messages, and that he insulted some and threatened bodily violence towards others. Andrew Mushore—the corporate’s former chief compliance officer and a respondent within the case, who the OSC alleges helped David cowl up among the fraud—was a specific focus of David’s ire. In one voicemail, he allegedly advised Mushore, “I hope you remember you signed off on all these deals, eh?” and likewise threatened, “I’m going to fucking pound your face!” (Mushore didn’t reply to interview requests for this story.)

Nearly a 12 months after Bridging was put into receivership, the OSC launched its formal allegations on the finish of March 2022. Bridging and the Sharpes, as soon as thought of the invincible masters of danger, had been accused of fraud, misappropriated funds, self-dealing and deceptive investigators. Investors stood to lose greater than $1.6 billion.

The Sharpes have denied the allegations towards them. For almost a 12 months, they lobbied to get the case thrown out, arguing that the OSC dedicated an abuse of course of when it publicly launched a portion of David’s testimony with its receivership utility. They had been unsuccessful, and the listening to began in June of this 12 months. It’s scheduled to stretch over 35 non-consecutive days, with the final in February 2024. Several former Bridging workers will testify in courtroom, and so too will Rishi Gautam.

In September, Dennis McCluskey, a former senior adviser at Bridging since 2015 who additionally sat on the credit score committee, made his look. He alleged that loan-approval paperwork had been typically altered for causes he discovered unclear. He additionally mentioned that he and different credit-committee members had been typically not sure what the cash was actually used for. He testified that he discovered one loan-approval course of so unusual that he forwarded copies of his approval suggestions to his personal e mail deal with. McCluskey mentioned he additionally raised questions concerning the $32-million Ng mortgage—particularly why Ng’s title didn’t seem on any of the paperwork—however his considerations had been dismissed.

The Sharpes, nevertheless, won’t seem and have refused to take part within the proceedings towards them. They each declare to not belief the equity of the Capital Markets Tribunal based mostly on the OSC’s launch of David’s testimony. (Tribunal hearings themselves are public; compelled testimony given to the OSC, previous to any official listening to, is normally not.) David has since vowed to pursue the matter of his testimony in courtroom, even because the OSC case marches on. One of his legal professionals, Brian Greenspan, advised CB that David appears ahead to difficult the OSC in courtroom and believes the OSC violated his Charter rights. “These Charter violations are magnified as Mr. Sharpe is First Nations,” Greenspan mentioned in a written assertion, “and in light of the history of the violation and indifference to the rights of Indigenous people by government.” Natasha’s legal professionals, in the meantime, didn’t reply to interview requests.

Ultimately, as famous in Greenspan’s assertion, David believes that in relation to Bridging, the true downside—the true travesty for traders—is the pressured, “OSC-instigated” receivership. Before the corporate was put into receivership, he claims, Bridging was taking steps so as to add new board members and rectify sure OSC considerations. This would have preserved the worth of the corporate’s funds, he insists, and stored it within the fingers of “expert management.” Instead, he argues, the receivership will probably finish in a lose-lose state of affairs for everybody however PwC—which, he alleges, will revenue from “unreasonable and egregious fees.” In his thoughts, the blame has landed on the flawed ft. “The receiver has focused on a wealth-destroying litigation strategy with no regard for investors,” he mentioned through Greenspan’s assertion. “The real story here is the conduct of the OSC and the conduct of the receiver.”

In the meantime, each McCoshen and Ng—the latter of whom was fined $5 million by the IIROC and can also be going through legal fraud prices—have disappeared. Ng didn’t present as much as his Toronto listening to within the late spring of 2022 and refused to cooperate within the investigation. His ex-wife has filed a lawsuit towards him alleging that he created a bogus household belief—used to carry tens of millions in closely mortgaged properties—shortly after the regulatory investigation. Its supposed actual goal: to assist Ng evade his collectors. (Ng has denied these accusations, in addition to the legal allegations towards him.)

That Bridging operated so boldly, and with such impunity, speaks not simply to inadequate oversight but additionally to a monetary business laser-focused on cartoon greenback indicators

McCoshen is now likewise averse to the highlight he as soon as chased. The day earlier than David Sharpe gave his fateful OSC testimony, McCoshen appeared earlier than the House of Commons transportation committee, promising the various advantages of his railway venture. He spun his well-worn yarn about wanting to assist First Nations. It was the final time he was seen in public. Through his lawyer, McCoshen has refused to reply any of PwC’s many questions, claiming that he’s too ailing to talk. In August 2021, he filed for chapter in Oregon, stating that he was, till shortly earlier than submitting, residing in a medical-care facility in B.C.

Related: How Canada’s Crumbling Health Care System Opened the Door to For-profit Virtual Care

Bridging’s failure triggered a cascade of lawsuits towards different firms and folks inside its orbit. In an try to recoup some cash for Bridging traders, PwC sued Peguis First Nation, its chief and its council, in addition to two companies created by the First Nation, for $170 million in early 2023. (Representatives for Peguis didn’t reply to requests for remark.) A number of months later, PwC launched one other lawsuit, this one towards KPMG, the multinational accounting big answerable for auditing Bridging’s earnings funds. PwC is suing the agency for $1.4 billion. It alleges that if KPMG had performed its job correctly, it could have caught the Sharpes’ alleged monetary con. Or, as PwC places it within the lawsuit: “Throughout KPMG’s tenure, the Bridging funds materially misrepresented the value of their assets and financial performance. KPMG negligently failed to detect and report on these misstatements.” (In an announcement, a consultant from KPMG wrote: “KPMG takes its role and responsibilities as auditor very seriously and stands behind its work as auditor of the Bridging funds. We have never been the auditor for the Manager, Bridging Finance Inc. We are confident in our audit work and will vigorously respond to the allegations made in the statement of claim.”)

But it isn’t simply Bridging’s receiver that’s petitioning the courts within the wake of the fallout. One B.C.- based mostly railway firm, G Seven Generations, filed a lawsuit towards David Sharpe alleging that, after a number of conferences in 2015, McCoshen and Sharpe stole proprietary route data and used it to plan the A2A venture. The railway’s CEO, an Indigenous man named Matt Vickers, claims the fledgling business relationship fell aside after he refused to present McCoshen a kickback price for arranging a possible mortgage with Bridging. Even the RCMP has began an investigation towards Bridging, though no prices have but been laid.

As the OSC listening to continues, the lesson is already clear, and it’s an outdated one: If one thing appears too good to be true, it in all probability is. That Bridging operated so boldly, and with such impunity, speaks not simply to inadequate oversight but additionally to a monetary business laser-focused on cartoon greenback indicators. The course of, the small print and the true price of danger usually seem to matter a lot much less. David and Natasha Sharpe advised traders, regulators, auditors and the media that they, and their buddies, had been savvy deal-makers with hearts of gold. For years, everyone believed them, just because they needed to.

Source: canadianbusiness.com