Safra Catz, Oracle’s CEO after which one among Oracle’s two co-CEOs, smiles throughout Oracle’s OpenWorld convention in San Francisco on, Sept. 20, 2016.

David Paul Morris | Bloomberg | Getty Images

Oracle shares rose as a lot as 4% in prolonged buying and selling on Monday after the software program firm reported outcomes for the fiscal second quarter that topped analysts’ estimates. But it supplied a lighter earnings forecast than analysts had predicted.

Here’s how the corporate did:

- Earnings: $1.21 per share, adjusted, vs. $1.18 per share as anticipated by analysts, based on Refinitiv.

- Revenue: $12.28 billion, vs. $12.05 billion as anticipated by analysts, based on Refinitiv.

With respect to steering, Oracle CEO Safra Catz stated on a convention name that she expects $1.17 to $1.21 in adjusted earnings per share and 17% to 19% income progress for the fiscal third quarter. Analysts polled by Refinitiv had anticipated $1.24 per share and $12.34 billion in income, which suggests 17.3% progress.

Oracle’s complete income grew 18% 12 months over 12 months within the fiscal second quarter, which ended on Nov. 30, based on a assertion. Health care software program firm Cerner, which Oracle acquired for $28 billion in June, contributed $1.5 billion in income.

Without the influence from foreign-exchange charges, Oracle’s adjusted earnings would have been 9 cents greater, the corporate stated. Revenue for the quarter was over $200 million above the excessive finish of its steering vary, Catz stated within the assertion. She cited power in cloud infrastructure and cloud-based purposes.

“We really have it coming from all areas,” she stated on Monday’s name.

Net earnings was $1.74 billion, in contrast with a internet lack of $1.25 billion within the year-ago quarter. Last 12 months’s loss got here in connection to a fee for a judgment tied to Mark Hurd, who beforehand served as co-CEO alongside Catz. Hurd died in 2019.

Oracle widened its adjusted working margin to 41% from 39% within the earlier quarter.

Catz stated Oracle is not completed integrating Cerner.

“We are already having some level of savings but ultimately just so that you understand, our expectation is we will run them at typical Oracle margins,” she stated. “So we’ve got quite a way to go. And I think over the next couple of quarters you’ll see continued improvement as we’ve done some of our operational integration and simultaneously I think they continue to over-perform for us.”

The firm’s cloud providers and license help phase posted $8.6 billion in income, up 14% and better than the $8.56 billion consensus amongst analysts polled by StreetAccount. Revenue from cloud infrastructure jumped 53% to $1 billion.

Revenue from cloud and on-premises licenses, at $1.44 billion, exceeded the $1.24 billion StreetAccount consensus.

In the quarter Oracle introduced Alloy, a method for companions to run the corporate’s cloud providers in their very own information facilities. Separately, the U.S. Securities and Exchange Commission fined Oracle $23 million over alleged violations of the Foreign Corrupt Practices Act.

Oracle stated it was aiming for $65 billion in natural income, together with Cerner’s contribution, within the 2026 fiscal 12 months, with a forty five% adjusted working margin.

Prior to the after-hours transfer, shares of Oracle are down about 7% for the 12 months, whereas the S&P 500 index has tumbled 15% over the identical interval.

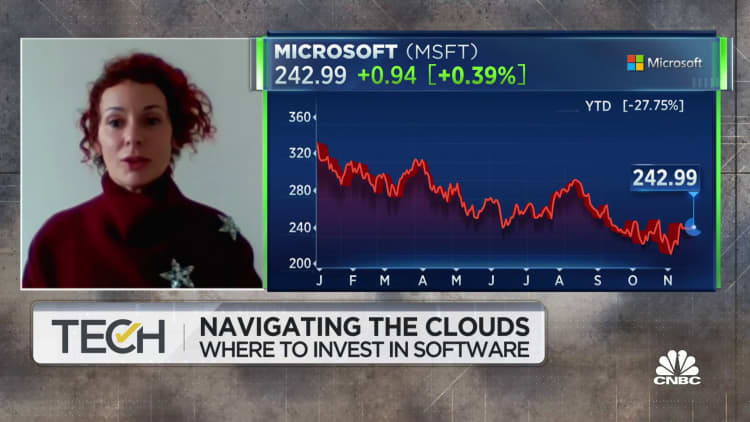

WATCH: Two takes on the software program house with Baird’s Will Power and Mighty Capital’s SC Moatti